Format

Full

City

Houston

State/Province

TX

Country

USA

Metro Area

Houston

Project Type

Mixed Use

Location Type

Suburban Business District

Land Uses

Cinema

Fitness Center

Hotel

Multifamily Rental Housing

Office

Parking

Plaza

Restaurant

Retail

Single-Family For-Sale Housing

Streets

Keywords

Healthy place features

Loft apartments

Main street retail

Mall redevelopment site

Mixed-use development

Pedestrian-friendly design

Place making

Town center

Urban village

Site Size

47

acres

acres

hectares

Date Started

2004

Date Opened

2010

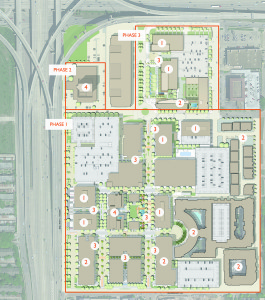

CityCentre is a mixed-use urban development that currently encompasses five office buildings, three multifamily residential options, brownstones, two hotels, streetfront restaurants and retail space, conference space, a cinema, a health/fitness facility, and parking. The project has been developed on a 37-acre site—recently expanded to 47 acres—formerly occupied by a retail mall that was failing. The development strategy involved demolishing all the existing retail buildings but retaining the three existing parking structures. The plan revolves around a central open space/plaza that is surrounded by hotel, office, restaurant, and retail uses. The design features several internal streets and a pedestrian-friendly environment.

The Site and the Idea | Development Background | Development Concept | Development Finance | Planning and Design | Marketing, Management, and Leasing | Observations and Lessons Learned | Project Information

The western suburbs of Houston are known for the Energy Corridor and its high-rise office buildings, leafy residential neighborhoods, high-income demographics, and wide highways. The area has not been known for pedestrian-friendly environments until recently, when CityCentre opened in 2009. When Brad Freels, chairman of Midway, and his team started planning CityCentre, he began with the thought that western Houston was almost completely lacking in walkable urban places. “I live about two miles from CityCentre,” notes Freels, “and I often wondered why the area did not offer an environment where you could meet someone for dinner and then linger afterward in an urban and pedestrian-friendly setting.” With CityCentre, he and his development team set out to prove that such a place would succeed in Houston, just as it has in most other cities around the country and the world.

Access to this robust content is a key benefit of ULI membership.

Become a member today to gain unlimited access to ULI Case Studies.

Become a Member Learn more about membershipThe Site and the Idea

The bulk of the CityCentre site was for many years the home of the Town & Country Mall, a regional shopping center first opened in the early 1980s that was anchored by several department stores, including JCPenney, which left the mall, and Neiman Marcus, which still owned and operated a department store on the site when it was acquired. The original mall site consisted of 37 acres. In 2013–2014, the developers acquired two adjacent parcels to the north: a 3.5-acre site occupied by a Four Points hotel and a 6.4-acre parcel occupied by aging office buildings, expanding the project site to about 47 acres. The original 37-acre site is roughly square—1,250 feet by 1,250 feet—a nice shape for creating a walkable community.

The site is located about 14 miles west of downtown Houston at the intersection of two major Houston highways—Interstate 10 and Beltway 8. I-10 is the major east–west highway in Houston that connects downtown Houston with the Energy Corridor to the west. Beltway 8 is the second major ring highway that surrounds the center of Houston; it runs north and south where it intersects with I-10. The site abuts Beltway 8 and its adjacent feeder roads, and with the addition of the two new parcels, the site is now directly adjacent to I-10 as well.

Immediately to the south of the site is Town & Country Village, a 400,000-square-foot open-air retail center, which surrounds surface parking and includes Barnes and Noble, Gap, Talbots, Chico’s, and numerous other tenants. A new office building is currently being built in Town & Country Village on a site adjacent to CityCentre. Directly to the east of the site are low-rise residential neighborhoods.

Because of Houston’s strong westerly growth patterns, the site is very near the demographic center of the Houston metropolitan area. The site is located in one of the wealthiest zip codes in Texas, with a median household income of $208,000 and a population of 700,000 within a seven-mile radius. About 500,000 cars pass the site each day. It is located in the second-largest office market in Houston after downtown, with 40 million square feet of office space in the nearby Energy Corridor and Westchase Business District, including corporate headquarters for BP, Shell, ExxonMobil, and BMC Software. About 2 million people can reach CityCentre in 20 minutes.

Development Background

When the site was acquired in 2004, the Town & Country Mall, like many second-tier malls around the United States, had been in decline for several years, and it was losing market share, tenants, and customers to the nearby Memorial City Mall, located about a mile east on I-10. The former mall had declined in part because of the construction of Beltway 8 adjacent to the property, which made access difficult for a time. Once the beltway was completed, however, the site became a very strategic location. The mall had also expanded into a terrible market in the 1980s, which put a strain on its finances.

The mall’s lender, American General, foreclosed on the mall, and a local investor purchased the property from the bank lender at the end of 2003. That investor also acquired three unoccupied anchor parcels part of the mall but owned separately. The investor made interim plans to redevelop the mall, which was still operating with one anchor—Neiman Marcus—and 46 retail tenants.

One of the problems that the investor faced was the reciprocal easement agreements in place with Neiman Marcus, requiring the mall to continue functioning as long as Neiman Marcus was operating the department store. With only a handful of tenants still operating in the mall and many tenants planning to leave once their leases expired, the mall operation was increasingly unprofitable.

Midway, a Houston-based developer active in the immediate area, was attracted to the site because of its prime location. In early 2004, Midway made an unsolicited offer to purchase the property, which was accepted. The property was never put on the market.

During the due-diligence period, the developer reached out to Neiman Marcus to gauge its intentions going forward. Much to Midway’s surprise, it learned that Neiman Marcus executives were positioning the company for a sale and wanted to unload several underperforming stores, including the store on the CityCentre site. Midway made a successful bid to acquire the store and site, which greatly improved its options for redeveloping the larger site.

Houston-based Midway is a privately owned, fully integrated real estate investment and development firm that has been in business for more than 46 years. Midway’s portfolio of projects completed or underway consists of about 42 million square feet of properties in 23 states and northern Mexico, including mixed-use environments, corporate headquarters, business and industrial parks, medical and laboratory facilities, hotels, multifamily homes, and master-planned residential communities. Midway’s current focus for development is in the area between downtown Houston and the Energy Corridor to the west of downtown. Notes Jonathan Brinsden, CEO of Midway, “Our philosophy is to look for great real estate and then figure out what the highest and best use is for that real estate.”

Development Concept

When Midway acquired the mall site, the company had no specific plan in mind. “We knew we had a clean slate and a lot of parking,” notes Shon Link, executive vice president of development for Midway. “We didn’t necessarily know what we were going to do with the property when we purchased it.” Midway did know that the site was large and extremely well located, offering numerous options for new uses.

In developing a use plan for the site, the developers felt that at the very least they could develop a residential neighborhood on the property, but they also felt that a strong market existed for offices, rental apartments, and a hotel. In fact, no full-service hotel had been built in the market since 1981, and the last Class A multifamily project in the zip code was built in 1974. Even though the mall had failed, with a new plan and new uses, Midway thought a strong market also existed for restaurants and retail space on the site.

Armed with the idea that a mix of uses in a pedestrian-friendly environment would be the best strategy for the property, the development team began researching mixed-use urban villages and town centers around the United States. Notes Brinsden, “We had never done a project this big” or with this many uses. Team members visited more than 25 mixed-use and town center developments in 17 cities, observing design details, tenant mix, strengths, and weaknesses and carefully noting what they liked and did not like. They measured various details related to urban design, such as sidewalk widths, the size and shape of public spaces, the proportions between street widths and building heights, and other features. Says Freels, “The tours helped us see what could be.”

Team members concluded from that and other market research that they would develop a mixed-use project that would be driven largely by office, multifamily, hotel, retail, and restaurant uses. The project, however, would not be designed or driven solely by the spatial layout needs of retailers, which was the case with many other projects they had visited. CityCentre developers sought to create a more balanced and stable environment that would serve the needs of office tenants and multifamily residents. Notes Shon Link: “Uses that are more substantial, such as the multifamily and the office, really need to drive the project. These uses have a longer lifespan than the retail. The retail has to be thoughtfully organized so that over time it does not diminish the value of the space above.”

They also concluded that if they could successfully integrate those uses within a compelling urban design, they could expand the marketability and trade area for the project and create a brand that would draw users from 15 to 20 miles away. Link notes: “These projects are really driven by public space. The public space, if you program it correctly and design it correctly, brings people to the project who wouldn’t normally come.” That space is not just for events, but is also an amenity for people who live and work in the development. Comments Freels: “We have worked very hard not to be in the commodity business, where all you have to compete on is price. You have to create a place where people want to be.”

The city of Houston was very supportive of the project, and its lack of zoning allowed for considerable flexibility in planning. The developers planned and platted the project, then parcelized it into separate development projects, which were submitted for building permits. There was no formal public participation beyond that, and all the streets on the interior are private.

Development Finance

Midway approached the project with the idea that it wanted to be the developer of most of the parcels but also wanted each project to be its own development. Notes Freels: “To us this was 13 different projects. They just all happened to be on the same site. The hotel was capitalized separately, had a separate owner, a separate architect, a separate contractor.” The same was generally true for the other buildings.

In looking for capital partners, Midway avoided the single capital partner approach, because it thought most capital partners would not want to finance such a large undertaking and would also be uncomfortable with a wide range of uses, both of which would in turn increase the perception of risk and the cost of capital for the overall project. Thus, Midway chose to finance the project by function, identifying separate partners for the multifamily, office, hotel, and retail uses.

Land acquisition financing. The land acquisition was structured as a land deal, meaning the developers planned to sell land to themselves for development. The original investors in the land acquisition were largely land investors and were not necessarily investing in the development aspects of the project. Midway agreed that the development partnerships for each parcel would pay the land partnership a higher price than the original parcel acquisition price. The land partnership still exists and has residual ownership in the three garages as well as in one of the office buildings and the hotel. The land investors have already gotten their money back and a great return, and if the garages are redeveloped, they will have the opportunity to realize additional returns.

The equity for the land acquisition came from a number of high-net-worth investors that Midway had worked with before. The original land deal involved roughly 60 percent traditional loans, 25 percent equity, and a 15 percent mezzanine loan from Cypress Real Estate Advisors.

When Midway bought the property, the company thought it was paying a lot, but land prices in the area have increased handsomely since that time. The original land parcel was purchased for $27 per square foot, and the most recent 2014 land parcel was purchased for $150 per square foot, including several existing and operational office buildings on the site.

Construction financing. Capmark Finance took the lead in securing a $94 million construction loan through Chicago’s LaSalle Bank to finance construction. Other banks also provided construction financing, including the local Amegy Bank, CitiBank Texas, Compass Bancshares Inc., and Guarantee Bank.

The project delivered in October 2009, a bad time in the financial markets. Two bank lenders for the project went under during the development phase—Guarantee Bank and LaSalle Bank. Both were taken over by other banks. But even with that takeover, new people had to be educated about the investment and the project.

Refinancing also became a problem. Notes Brinsden: “The hardest thing with the financial crisis was that you had development loans maturing, and you didn’t have anywhere to go. We were able to get extensions with the banks until we could arrange permanent financing, which we ultimately did.” That involved additional equity or fees. Most of the development loans expired around fall 2010. The project was largely refinanced in 2011 and 2012, when financial markets were strengthening.

Apartment/residential financing. The apartment financing and development involved several distinct approaches. As noted, Midway had obtained a mezzanine loan from Cypress Real Estate Advisors. As the project moved forward, Cypress asked for an option on one of the parcels. Midway and Cypress chose to carve out a parcel in the southeast corner of the plan that Cypress could buy and move forward with independently.

That parcel eventually became the Domain apartments, which were developed jointly by Cypress and the developer Simmons Vedder & Co. That parcel also included the site for the Ascent apartments. Cypress sold the completed Domain building and the site for Ascent to institutional investors advised by J.P. Morgan Asset Management. J.P. Morgan subsequently developed the adjacent Ascent site, using Simmons Vedder as a fee developer.

The financing plan also involved the sale of land to McGuire Homebuilders Inc. in 2007, which subsequently developed for-sale townhouses on the property—the Brownstones at CityCentre. By developing a compelling plan, the developers were able to sell that parcel for considerably more than the per-square-foot acquisition price. Both deals freed up capital for development of other buildings in the project.

The two Lofts apartment buildings, located above retail space, were developed by Midway and financed initially with investment capital from Reinsurance Group of America. The Lofts multifamily buildings were also ultimately sold to J.P. Morgan’s core fund, and J.P. Morgan and its investors now own the three major multifamily offerings at CityCentre.

Hotel financing. Stanford Financial partnered with Midway on the hotel initially, but Stanford Financial went into receivership in 2009, so Midway had to deal with a judge to resolve the ownership and financing. Midway was eventually able to use high-net-worth investors to buy out Stanford’s position.

Office financing. The lead investor in the CityCentre One office building was the Michigan State Pension Fund through its advisers L&B Realty. CityCentre Two was funded by a proprietary fund managed by L&B Realty Advisors. In September 2011, Alaska Permanent Fund Corporation, with LaSalle Investment Management as adviser, acquired CityCentre Two and entered into a partnership with Midway to develop CityCentre Three and Four on the western edge of the project. Alaska Permanent Fund is also the partner on the newly acquired parcel on the north side.

Retail financing. Midway and the Michigan State Pension Fund own the retail space in a joint venture, and together, with the help of adviser L&B Realty, they secured a senior mortgage loan in February 2012 for CityCentre Retail. Aegon provided the loan through its affiliate Transamerica, and the loan was arranged by Jones Lang LaSalle.

Planning and Design

In planning the project, Midway first developed a program of uses for the site and paid three firms to develop concept presentations. The team subsequently chose Gensler as the lead planner and architect. The local Houston architectural firm Kirksey was also brought in, together with the Office of James Burnett for landscape design.

During the planning process, Midway brought some of the Gensler architects in house—including Shon Link and Lee Cisneros—to help design and manage the development plan. Lee Cisneros, senior associate with Midway, notes: “The owner’s role as part of the design team is critical. The design needs a clear goal.” By bringing Gensler designers in house and onto the development team, Midway was able to play a very strong role in the design process. The design vision was driven in large part by Freels’s desire to create “a place where you did not have to get in your car every time you wanted to make a change in venue.”

The final plan involved creating an urban district rather than a retail-oriented town center. Over 100 iterations of the plan were tested before it was finalized. The plan included design guidelines for buildings, including materials, architectural styles, signage, and energy standards.

Plaza and streets. The plan is centered on a central plaza and public space that are surrounded by hotel, office, restaurant, and retail uses. The plaza includes walkways, landscaping, and a large water feature along Town & Country Boulevard, the main street that traverses the site from north to south. The plaza originally included an area of grass, but the lawn was so heavily used that the grass was replaced with green turf, and it is now a favorite place for children to play.

Directly adjacent to the plaza on the west is the 13-story Hotel Sorella, and to the north and south are one- and two-story restaurant and retail buildings with outdoor seating, which enlivens the plaza when the weather is pleasant. The signature CityCentre One office building faces the plaza on the east, across a pedestrian-friendly street that is paved much like the plaza.

Street layout, paving patterns, and curbs were carefully designed throughout the project to slow automobile traffic and to make pedestrian movement both easy and safe. There are no curbs, for example, along Town & Country Boulevard as it passes between the plaza and CityCentre One, and the street there consists of red and gray brick laid out in a circular pattern. Landscaping features also reach into the street, narrowing it and slowing traffic as a result. Notes Freels, “The cars are respectful of [the street plaza] because of the paving and the change in grade, and [the design] lets drivers know that the pedestrian is in control here.” A similar paving pattern is used along Sorella Court in front of Hotel Sorella.

Three other streets surround the central block and plaza and shape the urban design pattern. Sorella Court, a second north–south street, provides access to Hotel Sorella and parking garage one. CityCentre Way, south of the plaza, is a two-block street running east–west that connects to Town & Country Boulevard. Plaza Way is a two-block street located to the north of the plaza block that crosses Town & Country Boulevard and provides access to two parking garages from the project’s interior. The project is bounded on all sides by streets with sidewalks.

Architecture and urban design. The placement, massing, and design of the buildings were driven in part by the Houston climate, which can be very hot and humid in the summer. The hotel, for example, has been placed to provide shade for the plaza in the afternoon. Natural directional breezes were also considered in the plan, and the design incorporates shaded areas wherever possible through the use of trees, overhangs, covered walkways, and arbors.

Gensler worked on the master plan and designed the hotel, CityCentre One, and several other buildings. Kirksey worked on the plan and designed the Lofts apartments and the CityCentre Three, Four, and Five office buildings. Munoz+Albin also did design work on those three office buildings, as well as on the new buildings planned for the new north parcel.

The Domain and the Ascent, developed by Simmons Vedder, were designed by Steinberg Design Collaborative LLP. The use of different architects created a variety of building looks that add an authentic character to the development. The developers and designers sought to create a timeless design that would enhance long-term value. The buildings generally use modern designs with varying materials and architectural treatments.

Hotel. The signature hotel for the property is Hotel Sorella, located between the plaza and Sorella Court. It anchors the center of the project, together with the plaza, and is a key element in the overall plan. The 13-story hotel includes 255 rooms, with a lobby lounge and wine bar, outdoor patios, and a pool, all on the second floor facing the plaza. Those elements enliven the plaza area from above while allowing guests to enjoy watching activities in the plaza. That design allowed the location of restaurants on the ground level of the hotel, which activates that space more than a hotel lobby would.

The property also includes a second hotel—the Four Points by Sheraton Houston West—

located on a largely freestanding site in the northeast corner of the property, adjacent to parking garage one. The property was acquired in 2013 and is being held for future repositioning/redevelopment.

Offices. CityCentre currently includes five office buildings and 625,000 square feet of office space. The signature office building is the five-story CityCentre One, located on the plaza facing the hotel. The hotel and office building together frame the public space and form the center of the project. CityCentre Two and Five are located on the north side adjacent to Town & Country Way and include ground-level restaurant and retail space. CityCentre Three and Four are six-story buildings located to the west, facing Sorella Court and Beltway 8; those buildings include restaurants at the base on the court.

The latest office building to be developed—the 15-story CityCentre Five—includes 200,000 square feet of space, with 25,358-square-foot floor plates, 20-foot floor-to-floor heights on floors three, five, and seven, and floor-to-ceiling glass curtain walls. The recently added north parcel will also contain additional office towers in later phases.

Apartments. Three major multifamily products are offered at CityCentre. The largest is the Domain, which is located on the east side of the site and features a concave building facade and entrance area that surrounds a large half-circle plaza at the end of CityCentre Way. The Domain includes 360 upscale apartments in a five-story building with a parking garage near the center. Units vary in their orientation: some face the half-circle plaza, some face the interior courtyards, some face an adjacent apartment building, and still others face Town & Country Lane and nearby residential areas.

The Domain’s design involved a different process from many of the other elements. As noted earlier, this parcel was sold to one of the land partners in the deal, which brought in Simmons Vedder to develop the building. Midway subsequently negotiated with Simmons Vedder on the design: if Simmons Vedder built a project that worked with the overall CityCentre plan, Midway would extend CityCentre Way to the front door of the building as an internal entrance. Simmons Vedder also had the option of orienting the entrance to the surrounding streets but chose to put the front door within CityCentre, resulting in the road extension and the concave courtyard entrance. The Domain contains no retail space.

Next to the Domain at the southeast corner of the site is the newest apartment building to be developed, the Ascent, a six-story structure. This parcel was sold by Simmons Vedder to J.P. Morgan, which worked with Simmons Vedder on a fee basis to develop 160 high-end apartment units on a largely square site, with an open courtyard at the center, allowing for both outward- and inward-facing units.

In addition, Midway developed two separate five-story apartment buildings—the Lofts—with retail space on the ground level, in the southeast quadrant, with a total of 250 luxury units. They were designed by Kirksey. One building is sited along Town & Country Boulevard and the other along Sorella Court; both are also adjacent to Queensbury Lane. The buildings face each other but are separated by a block of two-story buildings devoted largely to restaurant uses. The Lofts offer a facade with varying setbacks.

Twenty-one luxury apartments—the Residences at Hotel Sorella—are located at the top of the hotel and are available for lease.

Townhouses. A parcel on the northeast corner of the site was bought and developed by a townhouse developer and has been built out with 35 three-story brownstones that face either exterior residential streets or interior mews. These townhouses have access to the center of the project through a pedestrian walkway that runs between the Domain apartment building and parking garage three.

Conference space. An independently run, 33,000-square-foot conference facility—the Norris Conference Center—is located on the second level of the building at the corner of Town & Country Boulevard and Plaza Way. A second conference space—operated by Hotel Sorella—is located beneath the Norris space. This latter space was originally planned for retail uses, but the hotel needed additional dedicated conference space, so the space was leased to the hotel. An enclosed second-level walkway connects Hotel Sorella to the conference space.

Health/fitness club. A 140,000-square-foot Life Time Athletic fitness facility, including a spa and café, is located in a multistory building across Town & Country Boulevard from the Norris Conference Center. It includes an indoor soccer field, three full-size basketball courts, a three-story rock-climbing wall, and three swimming pools, including one outdoors.

Cinema. An eight-screen cinema is located in a two-story building on the north side of Town & Country Boulevard. Operated by Studio Movie Grill, the facility offers lounge areas for premovie cocktails as well as in-theater dining.

Restaurants. There are 23 restaurants and eating establishments of all varieties in CityCentre. Several open directly onto the plaza, including Yard House and Straits in the base of the hotel and Ruggles Green and Red Mango to the immediate north and south of the plaza, respectively. Several other major restaurants are located on the first and second levels of the two-story building on the block south of the plaza, including the Houston Texans Grille, Eddie V’s Prime Seafood, Grub Burger Bar, and RA Sushi. A Brio Tuscan Grille is also located in this area at the base of one of the Lofts apartment buildings on Town & Country Boulevard.

Texas de Brazil, the Tasting Room, and Sal y Pimienta are clustered at the north end of Town & Country Boulevard. The most recent restaurant additions include Seasons 52 and Capital Grille, located on the lower levels of CityCentre Three and Four, respectively, on Sorella Court on the west side of the development.

Freels believes the restaurants were critical to the urban design and place making: “If we get the right restaurants in here, we can change how people view” the place. “People now say, ‘Let’s go to dinner at CityCentre,’ and they figure out which restaurant after they get there.”

Retail. About 20 retailers are located in the center, primarily along Town & Country Boulevard. Retail space is located on the ground level of the office and apartment buildings along that street, as well as on the ground level of the Norris Conference Center building, the Life Time Athletic building, and the restaurant and retail building on the south portion of the site between the Lofts buildings. Retail space is also located along Sorella Court at the base of the buildings.

Parking. Three major parking structures, all part of the original mall property, were retained and refurbished. The largest is parking garage one, located in the northwest corner of the site. Parking garage two is near the southeast corner, and garage three is near the northeast corner. Narrow surface parking lots are located along the Beltway 8 frontage.

Both angled and parallel street parking are offered as well throughout much of the project. Originally those spaces were unmetered, but meters were added to ensure proper turnover for retailers and restaurants. Valet parking is offered as well.

Parking is also provided separately in the apartment and office buildings, depending on their location. For example, the latest office building to be built—CityCentre Five—includes a dedicated nine-level garage with a parking ratio of three spaces per 1,000 square feet.

The project was able to use shared parking to reduce the number of spaces required. Shared parking occurs primarily among hotel, office, retail, restaurant, cinema, meeting space, and fitness facility users. The apartments have their own dedicated parking. A mixed-use shared-parking code was applied to the site, following guidelines in the ULI book Shared Parking.

Phasing. The developers felt it was important to open with a full range of uses and the signature public space in place. Thus, when CityCentre opened in 2009, it boasted 1.8 million square feet of space, including the hotel, CityCentre One, the Domain, the two Lofts apartment buildings, retail space, restaurants, the fitness facility, the conference center, and the cinema. Additional phases generally involved single office and apartment buildings as markets developed, including the addition of CityCentre Three, Four, and Five and the Ascent apartments in 2012–2015.

Midway recently acquired 6.4 additional acres on the north side that it is planning to redevelop with two office buildings and one apartment building, together with additional retail and open space, creating a gateway entrance from I-10. That new phase is expected to come on line in 2017, but the developer will not break ground on the office space without preleasing.

Marketing, Management, and Leasing

The project opened in August 2009, a very difficult time when the economy was still in the midst of the financial crisis and recession. Houston, however, was faring better than most other parts of the country, and the developers were able to effectively market and lease the office, apartment, and restaurant space that they were offering. Within one year of opening, the office and apartment space was more than 95 percent leased. The retail space was another story, however, especially because that leasing activity was left for the latter part of the process, when retailers had disappeared from the leasing market and were extremely reluctant to commit to new leases.

More than 15,000 people visit CityCentre daily throughout the day and evening hours. The development has received several awards, including the ULI Houston Development of Distinction Award for 2012.

Marketing. The project is marketed as “Houston’s destination to shop, dine, work & live!” The open space has become “the living room for the community where people come and hang out,” relates Brinsden, and that has been a critical element in marketing the project. The space itself attracts tenants and users.

Notes Dana Efthim, director of marketing for Midway, “We started with the strategy that we wanted people talking about us rather than our talking about ourselves.” Creating community means taking a very active approach to programming. “The community really has embraced the project as its own, which is what you want,” says Brinsden. “Advertising is really you talking about yourself, and we try to get other people talking about the project through events [and public relations]. That has much greater value.” Midway hired a PR firm, Studio Communications, which developed a plan to promote the project and all its elements.

Midway also publishes District magazine, a lifestyle publication; 25,000 copies are sent out by direct mail, and another 4,000 are distributed on site. The magazine is published biannually in the spring and fall. The company also uses social media—including Facebook, Twitter, Instagram, and LinkedIn—to communicate with its customers about events or special offers. A firm called Social Uprise manages Midway’s social media activities.

Overall, about 80 percent of the marketing budget and staff time go to events and the magazine, with the remainder devoted to PR, social media, and select advertising. Most of the marketing relates to the retailers and the restaurants, which benefit most when people visit the project.

Events. More than 380 events were held at CityCentre in 2013, with 15,000 to 20,000 people attending some of the larger events. Those events included live music on the plaza, a spring and fall art series, farmers markets, holiday markets and festivities, fitness classes in the plaza, dancing under the stars, moonlight movies, doggy parties on the plaza, a Lamborghini festival, and fashion shows, among others. Secondary streets are often closed for larger events. When they started the event program, the developers planned all the events. As of 2014, about half the events are planned by outside organizations.

Restaurant/retail leasing. More emphasis was placed on leasing the restaurants at first, with retail leasing taking a backseat. Freels recalls: “When we started the retail/restaurant leasing, we started with the restaurants because they often involve longer lead times. We put the retail leasing on the back shelf initially. It takes a restaurant 270 days to build out its space, whereas a retailer can do it in 90 to 120 days.”

The restaurants also came first because they were viewed as critical elements in shaping the project, more so than the retail space. Notes Brinsden: “Restaurants add real daily vitality. Patios add visual vitality. Restaurants were a real key from the opening. We have restaurants that are doing $1,200 per square foot.” Thus, the leasing team concentrated on the restaurants, the cinema, and the fitness center first.

The developers focused specifically on attracting restaurants for which CityCentre would be their first or second location in the Houston area. Both Yard House and Brio Tuscan Grille, for example, opened their first Houston restaurant in CityCentre. Those restaurants helped make the project a regional destination. Variation was also a key in restaurant leasing because the developers wanted to offer a broad range of prices and types of food. “Picking the [retail and restaurant] tenants is almost like curating space and is built around brand integrity,” notes Brinsden.

By the time they came back to do the retail leasing, retailers were not in an expansion mode. As a result, Midway and its financial partners decided to take a patient approach, preferring to wait for the right retailers to lease space rather than just trying to fill the space. For example, they held back a prime space in CityCentre One until they were able to attract J. Crew, a strong national tenant that in turn helped attract other national tenants. They tried to maintain a quality brand standard across all price points, including the movie theaters and the hotel. Retail preleasing was handled by Page Realty Partners Ltd.

Although that methodical strategy led to some vacant retail space for a while, Freels observes in hindsight, “I love the timing we had for retail because we could just wait out the storm” rather than fight with unhappy retailers during the downturn. They also benefited from patient investors who were willing to wait on the retail.

Retail leasing along Sorella Court, where two office buildings were recently completed, is now underway. Because that street was not developed on both sides until those office buildings were completed, the retail was slow to develop there. Once the office buildings were complete, things started to move. Two major restaurants opened recently in the base of the office buildings, and they, together with the hotel, have activated that street such that new retailers and entertainment tenants are now interested in leasing space there. However, the developers underwrote that retail space initially with the idea that it would lease sooner, and that decision was an error.

Notes Freels, “The only place where we have not exceeded expectations is with the retail, and that was a timing issue.” However, because of the percentage rents and strong performance of both the retail and the restaurants in place, “our economic occupancy looks much better than our real occupancy,” says Brinsden.

Leases include percentage rents, and the retailers and restaurants have been performing very well, exceeding initial projections. Average restaurant sales exceed $626 per square foot, while retail sales are about $475 per square foot.

Office leasing. The amenities and walkability have been key ingredients in the success of the office leasing. When Midway started planning the office buildings, the focus was on amenitized offices, which were not highly valued in Houston at the time. Brinsden notes that whereas leasing meetings in years past often involved a chief financial officer and a facilities director, they now always include the human resources director, and human resources teams are increasingly looking for elements and features that their employees want in a location, especially walkability.

CityCentre One and Five are 100 percent leased, and the Two and Four buildings are 95 percent and 98 percent leased, respectively. CityCentre Five was 65 percent preleased when construction began, and it is scheduled to open in summer 2015. The lead office tenant in that building is EMAS, a shipbuilder that has leased about half the space. Other major office tenants at CityCentre include McGriff, ERM, Texas A&M Mays Business School, Seacor Marine, Ventyx Energy, Cargill, and LLOG Exploration. Midway has located its offices in CityCentre One as well. Office preleasing was handled by Colvill Office Properties of Houston.

Rents are in the $25-to-$32-per-square-foot range, and rents have exceeded nearby competitors by about 10 percent.

Apartment leasing and rents. Apartment rents range from $1.75 to $2.50 per square foot in the various apartment buildings. A typical 958-square-foot unit in the Lofts rents for $1,866 per month. A 946-square-foot unit in the Domain is priced a bit higher at $2,186 per month, and the Ascent tops out the apartment offering at $2,545 per month for a 975-square-foot unit. All three offerings were 90 to 98 percent leased as of December 2014. The project has attracted many international residents who have chosen to live in the project, likely for its urban qualities.

Hotel management and occupancy. The hotel is operated by the Valencia Group, which also operates hotels in other mixed-use urban village locations, such as Santana Row in San Jose, California, and Country Club Plaza in Kansas City, Missouri. The hotel is one of the best-performing hotels in west Houston, with a revenue per available room (RevPAR) index of over 167 percent for its segment: a measure of 100 percent would be its fair market share. The hotel is on the Condé Nast Gold List’s top 500 hotels. Occupancy on the weekends is much higher than with competitive hotels in more suburban locations because of the range of amenities available to guests.

Management. An association manages the common areas, and all of the property owners and tenants contribute funds to the association on the basis of their occupancy in the project. In addition to funds from tenants and owners, the association also captures revenues from the newly added parking meters. Freels explains: “We will probably make $750,000 in parking revenue as a result of the addition of the meters. That money goes back into the association, which reduces the operating costs for all of the tenants and users.” Part of the parking revenue also goes to a charity.

Observations and Lessons Learned

When the project began, Midway was unsure of how much space could be absorbed and how dense the project should be. In hindsight, it has become clear that Midway could have developed the property at a higher density and achieved even greater success. The original office buildings were five stories, but the demand could have supported ten-story buildings. The newest buildings planned for the north parcel will be about 20 stories. There are opportunities to densify the site in the future.

Parking needs active management, especially street parking. The developers originally offered free valet, street, and garage parking but found that the street spaces were often used by long-term office users, when they were intended for short-term retail and restaurant users. To address that problem, they added meters to the street spaces to ensure that parking would turn over regularly.

Unlike freestanding restaurants, restaurants in mixed-use environments can often generate higher demand for parking in that people will linger after dining, and that can be a problem during peak times when parking can be scarce. A coordinated valet parking program can address that issue. At CityCentre, one valet operator serves all the restaurants, which avoids conflicts and results in a better, more coordinated overall valet system, as well as efficient use of parking during peak demand.

The developers have concluded that they might have been even more successful if they had approached the leasing of all uses in a more holistic way. They initially focused on leasing the office and restaurant space and neglected the retail space a bit, which became a problem when the recession hit, and soft goods retailers cut back on store openings. They could have put more emphasis on leasing the soft-goods retail space earlier.

Midway chose to develop most of the properties on the site, and that decision proved valuable for the project. Several other similar mixed-use projects were planned for Houston during the same time frame, but many did not go forward because they involved partnerships with individual developers for different components. In retrospect, one of the reasons the CityCentre developers were able to move forward was that they were the developers of the key components, and they were not going to back out. Freels describes his mind-set, “If we are going to do this, we had better be prepared to do every element of it.”

Timing is always an issue in development, but timing is rarely perfect for all phases of a large, long-term project. Notes Brinsden, “We signed construction contracts at the top of the market and delivered at the bottom of the market.” From a cost perspective, it would have been better to sign construction contracts during the depths of the recession, but the flip side of that would raise the question of whether the project could have been financed at that time. In the end, if the project had started much later than it did, it might not have happened until well after the recession. The developers had to suffer through a few slow years, but they are now enjoying a robust market for the project.

With a large, complex mixed-use environment, nothing is the same from one day to the next, and that creates challenges from an operational perspective. The numerous events and the changing intraday and intraweek user traffic patterns mean that management must always be prepared for surprises. Weather also greatly affects the operation of an outdoor-oriented environment like CityCentre.

Creating synergy among uses creates a lot of value. “That absolutely held true,” notes Brinsden. “And in some respects that exceeded our expectations. As great as that hotel is, if you picked it up and moved it a mile down the road, and it was [just] another hotel on a freeway, it wouldn’t be the same hotel and it wouldn’t perform as well.” One of the potential office tenants had lunch in the project before visiting the office building and decided to lease space without even seeing the inside of the building because he was so impressed with the environment. “We shifted the conversation,” observes Brinsden, “from renting space to delivering a place.” Place making, when done well, does pay dividends and can also be transformative for surrounding areas.

Project Information

| Development Timeline | |

|---|---|

| Year | |

| Mall site purchased/planning began | May 2004 |

| Neiman Marcus site purchased | 2004 |

| Mall demolished | Early 2005 |

| Construction started | January 2007 |

| Phase I completed (hotel, office, multifamily, retail) | August 2009 |

| Grand opening | Spring 2010 |

| CityCentre Two sold | September 2011 |

| Alaska Permanent Fund Corporation invests | September 2011 |

| CityCentre Three opens | 2012 |

| CityCentre Four opens | Summer 2013 |

| Four Points hotel acquired | August 2013 |

| Additional 6.4-acre north parcel acquired | 2014 |

| Ascent apartments open | 2014 |

| CityCentre Five construction begins | February 2014 |

| Completion expected for original development | August 2015 |

| Gross Building Area | |

|---|---|

| Use | Building area (sq ft) |

| Residential | 862,547 |

| Office | 625,000 |

| Retail/restaurants | 400,000 |

| Life Time Athletic | 140,000 |

| Hotel Sorella | 78,080 |

| Norris & Hotel Conference Center | 44,585 |

| Studio Movie Grill | 38,082 |

| Total GBA | 2,188,294 |

| Parking* | |

|---|---|

| Three original garages | 3,600 spaces |

| Total structured parking area | 1,082,246 sq ft |

| Site Area | Acres |

|---|---|

| Original mall site | 37* |

| Four Points Hotel parcel | 3.5 |

| North parcel | 6.4 |

| Total | 46.9 |

| *Excludes Four Points hotel and north parcel | |

| Residential Information | ||||

|---|---|---|---|---|

| Unit name/type | Number of units | Typical unit size (sq ft) | Percentage leased | Typical monthly rent |

| Lofts apartments | 250 | 958 | 100 | $1,866 |

| Domain apartments | 370 | 946 | 100 | $2,186 |

| Ascent apartments | 160 | 975 | 100 | $2,545 |

| Residences at Hotel Sorella | 21 | n.a. | n.a. | n.a. |

| Brownstones at CityCentre | 35 | n.a. | n.a. | n.a. |

| Total units* | 836 | |||

| Typical rents per sq ft | $1.75–$2.50 | |||

| * Excludes future development on north parcel. n.a. = not available. |

| Office Information | |

|---|---|

| Office net rentable area | 316,304 sq ft |

| Percentage of net rentable area occupied | 97.5 |

| Number of tenants | 24 |

| Annual rents | $25-$32 per sq ft |

| Average length of lease | 5-10 years |

| Major office tenants | Net rentable area (sq ft) |

| McGriff | 77,476 |

| ERM | 44,198 |

| Texas A&M School of Business | 29,865 |

| Seacor Marine | 25,742 |

| Midway Holdings | 24,625 |

| Ventyx Energy | 24,506 |

| Cargill | 22,112 |

| LLOG Exploration | 19,981 |

| Hotel Information* | |

|---|---|

| Number of rooms | 255 |

| Standard room size | 400 sq ft |

| Luxury room size | 1,200 sq ft |

| Residential room size | 1,800–3,100 sq ft |

| Range of room sizes | 400–3,100 sq ft |

| Occupancy rate | 80% |

| Average daily room rate | $221 |

| *Hotel Sorella only. |

| Retail/Restaurant Information | ||

|---|---|---|

| Percentage of retail GLA occupied | 75 | |

| Typical annual rent | $43 per sq ft | |

| Retail average annual sales | $475 per sq ft | |

| Restaurant average annual sales | $626 per sq ft | |

| Average length of lease | 10 years | |

| Key retail tenants | Retail type | GLA (sq ft) |

| Anthropologie | Apparel | 11,478 |

| Urban Outfitters | Apparel | 11,370 |

| Z Gallerie | Home furnishings | 8,111 |

| Sur la Table | Home furnishings | 5,999 |

| J. Crew | Apparel | 5,192 |

| Lululemon | Athletic apparel | 3,430 |

| Paper Source | Cards/gifts | 2,510 |

| Free People | Apparel | 1,786 |

| Kendra Scott | Accessories | 1,760 |

| Elaine Turner | Womens accessories/clothing | 1,363 |

| Key restaurant/cinema/lifestyle tenants | Type | GLA (sq ft) |

| Life Time Athletic | Athletic/fitness/spa/café | 140,000 |

| Studio Movie Grill | Cinema/casual dining | 38,082 |

| Eddie Vs Prime Seafood | Upscale dining | 11,465 |

| Houston Texans Grille | Casual dining | 10,746 |

| Seasons 52 | Upscale dining | 10,494 |

| Brio Tuscan Grille | Casual dining | 9,055 |

| Texas de Brazil | Upscale dining | 8,910 |

| Capital Grille | Upscale dining | 8,812 |

| Yard House | Casual dining | 8,531 |

| Tasting Room | Upscale dining | 6,794 |

| Straits | Upscale dining | 6,071 |

| Radio Milano | Upscale dining | 6,068 |

| Ruggles Green | Casual dining | 3,612 |

| Red Mango | Casual dining | 888 |

| Development Cost Information | |

|---|---|

| Site acquisition cost | Amount |

| Original mall site (2004) | $27 per sq ft |

| 6.4-acre north parcel (2014) | $150 per sq ft |

| Office development costs | |

| Hard costs | $85–$100 per sq ft |

| Total development costs | $240–$280 per sq ft |

| Apartment development costs | |

| Hard costs | $100 per sq ft |

| Total development costs | $150 per sq ft |

| Retail development costs | |

| Hard costs | $85–$100 per sq ft |

| Total development costs | $240–$280 per sq ft |

| Hotel development costs | |

| Hard costs | $200 per sq ft |

| Total development costs | $350 per sq ft |

| Financing Information | |

|---|---|

| Debt capital sources | Use/purpose |

| Aegon (Transamerica affiliate) | Retail financing |

| Cypress Real Estate Advisors(mezzanine) | Land acquisition |

| LaSalle Bank (bought by Bank of America) | Construction financing |

| Amegy Bank | Construction financing |

| CityBank Texas | Construction financing |

| Compass Bancshares Inc. | Construction financing |

| Guarantee Bank | Construction financing |

| Equity capital sources | Use/purpose |

| Midway Companies | All development |

| High-net-worth investors | All development |

| Alaska Permanent Fund Corporation | Office and retail |

| Michigan State Pension Fund | Office and retail |

| J.P. Morgan Asset Management | Apartments |

| Cypress Real Estate Advisors | |

| Stanford Financial | Hotel and retail |

| Reinsurance Group of America | Apartments |

| Investment advisers | |

| L&B Realty Advisors | |

| LaSalle Investment Management | |

| Financial intermediaries | |

| Jones Lang LaSalle | |

| HFF | |

| Capmark Finance | |

| Initial land acquisition | Percentage |

| Traditional loans | 60 |

| Mezzanine loan | 15 |

| Equity | 25 |

Format

Full

City

Houston

State/Province

TX

Country

USA

Metro Area

Houston

Project Type

Mixed Use

Location Type

Suburban Business District

Land Uses

Cinema

Fitness Center

Hotel

Multifamily Rental Housing

Office

Parking

Plaza

Restaurant

Retail

Single-Family For-Sale Housing

Streets

Keywords

Healthy place features

Loft apartments

Main street retail

Mall redevelopment site

Mixed-use development

Pedestrian-friendly design

Place making

Town center

Urban village

Site Size

47

acres

acres

hectares

Date Started

2004

Date Opened

2010

Website

www.citycentrehouston.com

Project address

800 Town & Country Boulevard

Houston, Texas 77024

Developer

Midway

800 Town & Country Boulevard

Suite 200

Houston, Texas 77024

midwaycompanies.com

Investors/owners

Alaska Permanent Fund Corporation

Cypress Real Estate Advisors

J.P. Morgan Asset Management

Michigan State Pension Fund

Reinsurance Group of America

Apartment developer (The Domain)

Simmons Vedder & Co.

Brownstone developer

McGuire Homebuilders Inc.

Master planners/architects

Gensler

Houston, Texas

www.gensler.com

Kirksey

Houston, Texas

www.kirksey.com

Landscape architects

Office of James Burnett

Houston, Texas

Kudela & Weinheimer

Houston, Texas

Architects

Munoz+Albin

Steinberg Design Collaborative LLP

General contractors

Burton Construction

Chambers Construction

Hoar Construction

Tribble & Stephens Construction

Structural engineers

Haynes Whaley Associates

Garza & McLain Structural Engineers Inc.

Mechanical, electrical, and

plumbing engineers

Thompson Company

Interviewees

Bradley R. Freels, chairman, Midway

Jonathan H. Brinsden, CEO, Midway

Shon M. Link, executive vice

president, development,

Midway

Lee Cisneros, senior associate,

development, Midway

Dana L. Efthim, director,

marketing, Midway