Format

Deal Profiles

City

Newark

State/Province

New Jersey

Country

USA

Metro Area

Americas

Project Type

Mixed Use

Location Type

Central Business District

Land Uses

Mixed Use--Three Uses or More

Keywords

Adaptive use

Affordable housing

Pedestrian-friendly design

The historic Hahne & Co. building was redeveloped by a joint venture between affiliates of L+M Development Partners Inc., Prudential, and Goldman Sachs from a once grand but vacant department store into a lively mixed-use development in the heart of downtown Newark, New Jersey.

Project Summary

The historic Hahne & Co. building was redeveloped by a joint venture between affiliates of L+M Development Partners Inc., Prudential, and Goldman Sachs from a once grand but vacant department store into a lively mixed-use development in the heart of downtown Newark, New Jersey. Built in 1901 at 609 Broad Street, the Hahne & Co. department store had stood empty since its namesake brand closed in 1987. The building rises four stories and is now linked to a nine-story tower constructed on an adjacent parcel for a total of 528,500 square feet. This adaptive reuse includes 160 apartments—both market rate and affordable—as well as 75,000 square feet of retail space. Rutgers University leases nearly 60,000 square feet of space for a community arts collaboration space and campus bookstore, and other tenants occupy over 40,000 square feet of office space. The Grand Court located under the building’s historic skylight provides access to several commercial spaces and serves as a community gathering area. The project also includes more than 200 underground parking spaces. The redevelopment opened in phases, the first in January 2017, and it was completed in late 2018 after five years of planning and construction.

The Site and the Idea

Newark is a major employment center and commercial hub of the U.S. Northeast. Having suffered serious decline in the second half of the 20th century, Newark’s downtown at the time of the Hahne building rehabilitation was characterized by a population of mainly office workers who vacated the area in the evening. Though some street activity remained because of the nearby New Jersey Performing Arts Center and Rutgers University, the area lacked vibrancy. Redevelopment of the site had long been recognized for its potential to help bring life back to the area, but several attempts to revive the building had foundered and it remained abandoned for 30 years until L+M broke ground in 2015. Because of the many challenges presented by this project, Tim Lizura, the former executive director of the New Jersey Economic Development Authority (NJEDA), once referred to it as “a site where developers came to die.”

The landmark department store building is located on a 2.39-acre site that occupies half a city block on the north end of downtown Newark; it is three-tenths of a mile north of the intersection of Broad and Market Streets, the center of the city’s street grid, and 0.45 miles northwest of Newark Penn Station. The Hahne building is located in the historic Central Ward (earlier known as the Third Ward), which includes many of Newark’s historic public spaces, and fronts on Military Park, downtown’s largest green space. When the rehab project was being conceived, the historic Military Park was undergoing a long-awaited revival by local stakeholders, thanks in large part to a substantial grant from Prudential.

The landmark department store building is located on a 2.39-acre site that occupies half a city block on the north end of downtown Newark; it is three-tenths of a mile north of the intersection of Broad and Market Streets, the center of the city’s street grid, and 0.45 miles northwest of Newark Penn Station. The Hahne building is located in the historic Central Ward (earlier known as the Third Ward), which includes many of Newark’s historic public spaces, and fronts on Military Park, downtown’s largest green space. When the rehab project was being conceived, the historic Military Park was undergoing a long-awaited revival by local stakeholders, thanks in large part to a substantial grant from Prudential.

To the west of the site is Halsey Street, a local commercial corridor; the Rutgers campus, with an enrollment of 12,000 students; and the New Jersey Institute of Technology, with an enrollment of more than 11,000. The area to the south was redeveloped simultaneously with this adaptive reuse project. The new 20-story Prudential Tower situated across New Street brought 6,000 workers to the downtown, but the area still lacked a significant mix of uses or any vibrancy.

These factors served as the context for the concept of multiple uses fused in the proposed program for the building. Lying at the nexus of important corridors of downtown Newark, the project was envisioned as a node around which the downtown could gather and grow. The dearth of residential options in the area was another important aspect of the development—providing the opportunity to address the need for market-rate and affordable housing while taking advantage of tax credit funding. As the project evolved, it was also tied into the institutional surroundings with the relocation of the Rutgers Department of Arts, Culture and Media. This community arts and education program facility, Express Newark, encourages the creation of a more mixed-use downtown, offering daytime and evening activity seven days a week.

Development Background/Process

Redevelopment of the property, now known as Hahne and Co., was spearheaded by a partnership between L+M, a New York–based developer with a record of success undertaking real estate developments in the five boroughs, and Prudential. L+M had been looking at New Jersey, particularly Newark, for development opportunities because it believed markets there had strong growth potential. The firm recognized that Newark had excellent infrastructure, beautiful historic buildings, and a motivated group of local stakeholders.

Because of the size and location of the Hahne department store, the redevelopment project originated with the idea of mixed uses, including a combination of apartments and retail and office space. These uses would be brought together under a four-story Grand Court running lengthwise through the building—this atrium capped by a steel-and-glass skylight that would serve as the focal point for the redevelopment.

The historic rehabilitation and conversion of the property centered on the removal, off-site restoration, and reinstallation of the skylight. Rebuilding of this feature, together with a reimagining of the original atrium space with the skylight relocated from the fourth to the second floor, proved to be challenging but ultimately paid great dividends.

L+M had not anticipated how complicated it would be to undertake the skylight work—or whether it was even feasible. The skylight had not been touched since World War II and had since been capped with asphalt, badly damaging the glass.

“We substantially evaluated its replacement and surprisingly found that the restoration was cost-effective when compared against the replacement,” says Jonathan Cortell, a managing director of L+M. Choosing to restore rather than replace the skylight also allowed the building to retain more of its original character. “We note here that preservation would enable an accurate representation of the building’s history, as modern skylight systems use lightweight aluminum framing members while the original steel includes exposed rivets and connections,” Cortell says.

Opting for restoration of the skylight also fostered a positive relationship with the New Jersey State Historic Preservation Office (NJSHPO) and the National Park Service (NPS). Restoration of the Grand Court was a requirement of the development, though restoration rather than replacement of the skylight was not compulsory. In addition to the Grand Court restoration, a historic aspect incorporated into the development was renovation of historic railings, exterior windows, the grand staircase, exterior facades, and the terra-cotta cornice.

At the core of the development strategy was the synergy created by the varied mix of uses and relocation of the skylight to the second floor, which allowed conversion of the third and fourth floors to provide 83 rental apartments. The developers saw the central vacant space in the Grand Court as a pivotal component of the structure because it facilitated layouts with interior-facing apartments.

Throughout the development process, and especially during the approvals phase, L+M juggled the varied requirements of several agencies. While local historic approval was reviewed by the Newark Landmarks and Historic Preservation Commission, NJSHPO, and the NPS, the site plan approval fell under the purview of the Newark Central Planning Board. Further, the Newark Building Department oversaw building code and construction details, and the hiring and contracting aspect of the project was reviewed by the city.

The developers faced significant challenges during the project, most stemming from the building’s years of neglect. Due to their lack of maintenance, the building elements required close evaluation, beginning with the cast-iron columns and steel beams. Because the columns were cracked in places, they were reinforced and encased in concrete at the roof. Because of the increased dead loads and structural changes to the building, and to ensure the structural integrity of the floors, a three-inch lightweight concrete slab was added to the original concrete floors and a new concrete perimeter wall was built on the inside of the facades to withstand expected wind loads and prevent moisture penetration. Much of this work was addressed through change orders, altering the original scope of work.

The new tower constructed at the corner of Halsey and New streets included ground-floor retail space and nine stories of residential units, including an additional 77 rental apartments. Further, the partnership converted about 60,000 square feet of space into education and community space, which was leased to Rutgers for Express Newark, its arts, culture, and media collaborative. Originally this space was designed to house a movie theater, but ultimately L+M changed course because the public assembly designation that would have come with that use required certain building structures that were not appropriate or financially feasible.

Among the most challenging components of the development process involved rollout of the tenant mix. Staggering the residential lease-up and construction of other project components, as well as the ownership structure of common areas, was an important aspect of the financial structure. Though L+M pushed for a phased execution of the new residential tower, staff for then-Mayor Cory Booker was steadfast in requiring that the tower be completed in the same phase.

Financing

Completion of a project of this scale and complexity required the financial backing of many stakeholders. Redevelopment costs for the Hahne & Co. project totaled $178.9 million. About $29.5 million of that was covered by sponsor equity from 609 Holdco Inc., a partnership that included an affiliate of L+M, Prudential’s Impact Investments Group, and Goldman Sachs Urban Investment Group. As the developer member, L+M contributed 27 percent of the equity and received a development fee at project completion. Consistent with its longstanding commitment to the downtown Newark community, Prudential contributed 70 percent of the sponsor equity, and Goldman Sachs contributed the remaining 3 percent.

In addition to the $8.7 million acquisition price, sponsor equity was used to fund investigative demolition on the site before construction financing. This gave the development team crucial insight into the building’s condition and facilitated a more accurate estimate for the private financing and public subsidy needs. This preliminary step had the added benefit of providing lenders with more comfort regarding the proposed redevelopment’s risks.

The remaining project financing was a mosaic of public and private sources. “It took a village to get this done,” notes Cortell. Public subsidies included nontaxable bonds through the New Jersey Housing and Mortgage Finance Agency’s (NJHMFA) Multifamily Conduit Bond Program,[1] New Market Tax Credit (NMTC) Qualified Low-Income Community Investment (QLICI) lending, federal historic tax credits, and 4 percent federal Low-Income Housing Tax Credits (LIHTCs). The project also received an Economic Redevelopment and Growth (ERG) grant from the New Jersey Economic Development Agency.[2] Construction lending was provided by Citibank, Prudential, Reinvestment Fund, and Low Income Investment Fund (LIIF). Permanent financing was also provided by Prudential. New Jersey Community Capital and Goldman Sachs served as the NMTC Community Development Entities (CDEs) for the project. In order to obtain National Park Service approval and receive historic tax credits, complete restoration of the Grand Court was a required.

Stitching together such a diverse array of funding sources required ingenuity on the part of the development team. For example, NJHMFA could not provide financing if less than 60 percent of building square footage was nonresidential. To meet this requirement, a condominium structure was created to separate the property into the following units:

- the HMFA condo—composed of all residential units, 40,000 square feet of first-floor retail space, and 10,000 square feet of second-floor commercial space;

- the NMTC condo—composed of a 30,000-square-foot Whole Foods Market and 30,000 square feet of second-floor commercial space; and

- the Rutgers condo—composed solely of 55,000 square feet of Rutgers University space.

Each condo was subsequently master leased to an investor entity. This condo structure not only maximized the amount of space eligible for HMFA financing and related tax abatement, but also helped L+M satisfy the unique rent restrictions and compliance periods associated with the project’s various public funding sources going forward. “I’m not sure we could simplify this structure,” says Cortell, “[but] I would have loved to because of the headache from assembling, from a reporting and ongoing operations standpoint.”

The Hahne & Co. redevelopment project was not without financing obstacles. Most notably, the closing of project financing was delayed about six months by a lengthy legislative extension process for ERG grant monies. This was a critical component of the funding structure, so the project could not proceed until this process was completed. The delay resulted in construction cost creep that led to a funding gap. Although the team was able to find additional funding sources to alleviate some of this gap, design modifications, such as scrapping plans for penthouse units on the top of the development, were also required to reduce the construction costs.

Planning and Design

The original Hahne building, although in decrepit condition, still had a considerable volume and appealing aesthetics. The ultimate success of this project was due to the forethought needed to combine the historic elements of the structure and site with forward thinking and an understanding of future market conditions. Public/private partnerships were also essential to effectuate this adaptive reuse project. Whereas earlier proposals for the site were structured with inadequate financial proposals and cut up the building in such a way that it failed to get state and NPS approvals, L+M followed the guidance provided by the NPS and visualized a concept that retained more of the original layout.

“We succeeded because we tried to imagine the building as an art piece, trying to restore something once fabulous. We were respectful of SHPO’s guidelines and developed a project that was true to NPS goals while also solving several design and logistical problems,” says Richard Weinstock, vice chairman and senior partner of L+M. “Prior developers had focused entirely on financials, cutting up the building differently, and couldn’t put together a project that worked and was true to NPS goals.” Although initially conceptualized with a modernist interior, later designs instead honored the imagery of the old department store. The original two-story staircase was reconstructed, along with the windows, railing, and millwork, to comply with the current code.

The original building, constructed as a department store, contained expansive floor plates. It was the reopening of the atrium that structurally allowed the possibility of interior-facing apartments to be incorporated into the project. The repurposing for multiple new uses required continual iterations to have the Grand Court function as the spine. With Whole Foods becoming an anchor tenant early in the planning of the project, other uses were swapped around in the planning process to satisfy various project requirements. The community benefitted from retention of the lower floors of the original structure for retail, community, and commercial uses. The presence of Rutgers also helped solidify the project because the university would occupy challenging space with deep floor plates. Notes Alex Merlucci, associate partner of Inglese Architecture + Engineering, “When we realized Rutgers was serious and wanted to take it, this was real.”

In preparation for an earlier attempt to renovate this property, the interior had been gutted and the interior corner of New and Halsey streets had been cleared to gain access to the basement. This portion was used to create the nine-story tower, which includes parking, ground-floor retail space, and eight stories containing 77 residential units. Another 83 apartments were housed in the upper floors of the older structure. Though the proportions of the original building were not completely conducive to new apartment layouts, only a section of the third and fourth floors was demolished to move back the rear walls and create terraces at the rear of the units.

Marketing, Management, Tenants, and Performance

Since its completion in 2017, Hahne & Co. has achieved high occupancy rates and rental rates that exceed the pro forma estimates. The earlier lack of grocery options and community spaces in downtown Newark plus strong community support for the project are key factors contributing to the performance of the redevelopment.

The project was positioned to appeal to a broad demographic of downtown Newark with its mix of affordable and market-rate apartments, as well as inclusion of a coworking concept and the Rutgers space. The affordable apartments appeal to people seeking amenities, including a grocery, within walking distance of their work. The market-rate apartments target people seeking the highest-quality residential units on the market, with washer/dryer units, cut wood floors, and double-height mirrors that also function as vanities.

“We tried to bring a New York experience to bear without certainty [that the market would] lap it up, but it was a necessary, conservative strategy,” says Cortell.

People seeking a shorter commute without sacrificing housing quality are a target market for Hahne & Co. In particular, potential tenants include employees of local firms Prudential, Audible, and Panasonic, as well as law and medical students and faculty at Rutgers and the New Jersey Institute of Technology. With a location near Newark Liberty International Airport, the Amtrak Northeast Corridor line, the Port Authority Trans-Hudson (PATH) rapid-transit line, the NJ Transit commuter line, and many other means of public transportation, Hahne & Co. is about 30 minutes from Midtown Manhattan and provides convenience while remaining less expensive than other options in Hoboken, Jersey City, and New York City.

Marketing programs for Hahne & Co. have included the use of social media and on-site events. Formal marketing efforts were aimed at its target markets, but the success of the project largely relied on providing the community with what it urgently needed. “We created a larger pool for affordable housing to market to appeal to the public’s needs,” says Cortell. “We were very cognizant of integrating into the product a range of product types. We utilized both new construction and adaptive reuse to provide aesthetic appeal. There were limited excuses regarding the food desert considering the transitional nature of the neighborhood.”

The residential leasing strategy is broken down into two categories: market-rate apartments and affordable apartments. 60 percent of Hahne & Co.’s units are designated as market rate and 40 percent as affordable—54 units reserved for tenants with incomes of up to 60 percent of the area median income (AMI) and 10 units for tenants with incomes of up to 40 percent of AMI. Occupants of the 64 affordable housing units are chosen by lottery, and an overwhelming 700 applicants applied for these units before their opening.

Both the market-rate and affordable housing comprise a mix of studio, one-, two-, and three-bedroom apartments. Market-rate units rent for an average of $3.24 per square foot for studios, $2.79 for one-bedroom units, $2.75 for two bedrooms, and $2.33 for three bedrooms. Affordable units rent for an average of $1.35 per square foot for studios, $1.22 for one bedroom, $1.02 for two bedrooms, and $0.86 for three bedrooms. Affordable units are 100 percent occupied, and the residential units are 97 percent occupied.

The commercial leases also vary. Rutgers’s 58,723-square-foot space contains a Barnes & Noble bookstore and Express Newark, which includes an arts incubator, communications media center, portrait studio, lecture hall, print shop, and gallery. This space involves collaboration with many other arts partners, including the Newark Museum, the New Jersey Performing Arts Center, Newark Print Shop, WBGO jazz radio, Gallery Aferro, and the nonprofit GlassRoots organization. It also hosts Rutgers’s Institute of Jazz Studies.

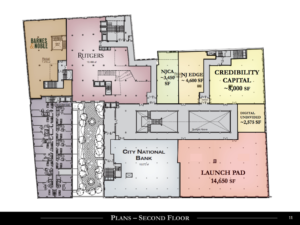

Addressing the food desert, Whole Foods occupies almost 30,000 square feet at the corner of Broad and New streets. Even before its opening, Whole Foods demonstrated its support for the community by creating a grants program to support local nonprofits, including using local vendors for the new store and employing about 110 area residents. Other tenants of the project currently include celebrity chef Marcus Samuelsson’s Marcus B&P restaurant, City MD Urgent Care, Kite and Key, Industrial Bank, New Jersey Citizen Action, and Credibility Capital. The development also includes almost 15,000 square feet of coworking space with Launch Pad. Hahne & Co.’s office portion was 100 percent occupied in January 2020 and its retail portion was 86 percent occupied.

Newer tenants in the building include CoolVines, an artisanal wine store across from Whole Foods on the Grand Court, and Sweetwaters, a coffee shop across from Marcus B&P on the Halsey Street end of the property. Just down the street, leasing has begun for L+M’s newest historic redevelopment and mixed-use concept, Walker House, formerly known as 540 Broad Street.

Hahne & Co. has been managed by Bozzuto since its opening. The project includes 220 on-site parking spaces. Of these, 103 are dedicated to Whole Foods, and the remainder are offered to residents of the building for $225 per month and are managed by SP Plus Corporation. However, because of the building’s proximity to several different types of public transportation, many residents do not own cars. Limited parking is provided for visitors to the building for an hourly fee. Limited metered street parking is also offered, and private parking garages and parking lots are located on bordering streets.

With over 60,000 square feet of common areas, Hahne & Co. has hosted many events since its opening, including a St. Patrick’s Day parade, trick-or-treating for children on Halloween, and events for local nonprofits. Express Newark has featured such exhibits as portraits of 100 influential people in Newark’s history and participated in events that include the Newark Arts Festival and Newark First Fridays. “The building had and hopefully will have an enormous amount of importance to folks in New Jersey,” says Cortell.

Observations and Lessons Learned

Perseverance, creativity, and vision were required of L+M to complete this complex mixed-income, mixed-use redevelopment. Very few comparable projects exist in Newark, which caused many to doubt the development team’s ability to succeed. Nonetheless, L+M was confident that the time was finally right to bring the project to fruition.

As is often the case with complex redevelopment projects in urban areas, L+M was not able to do it alone. The company credits strong, active, and committed leadership from the city government, community political support, and local institutions, particularly Prudential and Rutgers, all of which were focused on seeing the project succeed. With their support, L+M was able to creatively assemble the puzzle piece by piece, including the project’s complex financing structure.

L+M’s rehabilitation of the historic skylight and its relocation to the second floor, creating a smaller version of the former department store’s atrium, exemplifies a creative solution by the firm, preserving significant architectural elements while providing the opportunity to locate additional apartments on the upper floors. L+M was initially drawn to the building by its aesthetics and sought to preserve as much of the building’s history as possible.

As L+M and its partners hoped, the project has been embraced by the city and has played a significant role in the revitalization of its surroundings. In addition to increasing population density and providing much-needed retail options—with a Whole Foods to help address a substantial food desert—the project has also brought together members of the community. Neighborhood groups and local companies now regularly use the Grand Court for exhibits and parties. The project serves as a nexus among social groups at Rutgers, Prudential, and the New Jersey Performing Arts Center. Area residents, some of whom remember the Hahne department store, can take pride in the building’s rebirth and its contribution to their city and neighborhood.

Finally, Hahne & Co. has served as a catalyst for development in the area. Since Hahne & Co. opened, nearly 750 new apartments have come online or are planned, including One Theater Square, 50 Rector Park, Kislak, and Walker House, which L+M has redeveloped to provide 265 mixed-income apartments, offices, and ground-floor retail space. Walker House “would have been impossible without Hahne & Co.,” Cortell says. Based on its experience and success with the Hahne & Co. project, L+M is investing further in Newark’s renaissance with the redevelopment of the 440,000-square-foot former headquarters of New Jersey Bell (subsequently Verizon).

“I think this [new development] is just great for Newark,” says Alan Kane, former president and chief executive officer of the Hahne & Co. department store chain. “I’m so glad that it’s happening there.”

Cornell Real Estate Review Staff

Jennifer Spritzer

Executive Editor/Lead Case Study Author

Lera Covington

Senior Editor/Case Study Author

Joe McFalls

Editor/Case Study Author

Ryan Sequeira

Editor/Case Study Author

John Thompson

Editor/Case Study Author

Michael Tomlan

Academic Adviser/Case Study Editor

Dustin Jones

Academic Adviser

[1] The Multifamily Conduit Bond Program was created in 2011. It allows well-capitalized developers to issue bonds through the agency on a pass-through basis at the most competitive interest rates available in the marketplace.

[2] ERG was created as part of the New Jersey Economic Stimulus Act of 2009.

Format

Deal Profiles

City

Newark

State/Province

New Jersey

Country

USA

Metro Area

Americas

Project Type

Mixed Use

Location Type

Central Business District

Land Uses

Mixed Use--Three Uses or More

Keywords

Adaptive use

Affordable housing

Pedestrian-friendly design