Format

Deal Profiles

City

Chattanooga

State/Province

TN

Country

USA

Metro Area

Chattanooga

Project Type

Multifamily Rental

Location Type

Central Business District

Land Uses

Multifamily Rental Housing

Retail

Keywords

Adaptive use

Co-living

Co-working

Deal profiles

Dealprofiles

Downtown development catalyst

Downtown housing

Historic preservation

New markets

Regeneration

Tech-oriented tenants

Urban regeneration

Site Size

0.25

acres

acres

hectares

Date Started

2014

Date Opened

2016

The Tomorrow Building is a four-story, 40,000 square foot building in downtown Chattanooga, Tennessee that was originally built as a hotel in 1888. After a $9.5 million transformation, it houses 39 furnished micro-unit apartments, shared social and work spaces, and four locally owned retailers. The building’s developer is part of an incubator for early-stage companies, which has found that the co-living concept has helped with retaining employees.

Deal Profiles from the ULI Center for Capital Markets and Real Estate showcase how developers bring together financing for small but high-impact developments.

View a recorded webinar featuring a presentation and discussion about this Deal Profile.

The Site and Neighborhood

What is now the Tomorrow Building was erected in 1888 as the Delmonico Hotel, at the corner of Georgia Avenue and Patten Parkway in downtown Chattanooga. The hotel and an adjacent city market were built during the 1880s as downtown expanded south and east from Market Street, its historic spine. In 1925, the hotel reopened as the Ross Hotel, and after World War II the market was replaced with a war memorial. The hotel closed in 1979, but for years its ground floor was home to the Yesterday’s nightclub.

Back in 1986, during Yesterday’s heyday, leaders from the Lyndhurst Foundation and several local banks launched the River City Company (RCC). This nonprofit developer was initially tasked with implementing a 20-year regeneration plan for 130 acres of derelict industrial land along the Tennessee River.

Three recent plans that the RCC undertook set the stage for the Tomorrow Building. A 2013 City Center Plan envisioned a mixed-use future for downtown’s central business district, a Downtown Chattanooga Market Study found a pent-up demand for new rental apartments downtown, and a parking study found plentiful existing parking resources. The plan identified specific “properties that could jump-start the middle of the city,” says Kim White, president and CEO of the RCC, notably the Ross Hotel.

The Benwood Foundation, keen on catalyzing the implementation of the plan, pledged to support the RCC in the purchase of the Ross Hotel if the nonprofit could get the building under contract. The building’s longtime family owners had rebuffed offers from many other developers over the years, and it took numerous entreaties from White to “get the whole family on the same page with what the vision could be.” One family member had lived there during the 1970s, and White appealed to “her dream of getting more people living downtown”; unlike a speculator, the RCC both shared that vision and could bring it to fruition.

“While the money would have talked, it also took a lot of visits to get the project to move forward,” White continues. The RCC’s resulting request for proposals (RFP) for developers was “very intentional about what we wanted the program to be,” says Jim Williamson, vice president of planning and development for the RCC: per the plan, it should be rental apartments.

The Initial Idea

Not far away, the Lamp Post Group was solving a different sort of problem: hiring and retaining employees for the early-stage companies it incubates. The group was launched in 2010 by three college friends and supercharged in 2014, when its founders sold (for hundreds of millions of dollars) a third-party logistics company that they had also founded. The group launched Lamp Post Properties as a real estate arm that built out a coworking space to house the group’s ventures, capitalizing on downtown Chattanooga’s terrific historic buildings and high-speed fiber-optic municipal broadband infrastructure.

LPP piloted a co-living concept within a small apartment building nearby, master-leasing 14 apartments and paying new hires a stipend to participate in the experiment. Tiffanie Robinson, now president and CEO of LPP but then LPG’s chief operating officer, said that they were “having a hard time keeping talent . . . finding housing that was flexible and [that] connected [residents] with people outside of work,” an often-overlooked bit of social infrastructure needed by new arrivals working long hours at small companies.

After a year of tinkering, LPP was ready to try the experiment on a larger scale, just as the RCC released its RFP for the Ross Hotel, a block from its offices. At first glance, LPP saw the micro-unit concept as a perfect match for the old hotel, which was already divided up into small rooms and had larger common areas downstairs. It should be straightforward to repurpose much of the existing structure. Of the few RFP responses received, LPP’s was the clear winner.

The Idea Evolves

After spending $1 million on what had been estimated as a $4 million project, an estimate came in: asbestos remediation alone would cost $1 million. “Oh my gosh, that’s a lot of money,” Robinson recalls. “Then, the construction team thought the exterior walls would fall over.”

The project budget spiraled, eventually doubling the initial projected costs. Williamson says that in the end, “almost nothing was left except for the exterior walls—which was not the intention going in, and certainly not within the [original] budget.” Even worse, the degree of reconstruction required jeopardized the team’s initial plan to use historic tax credits (HTCs). Not only was additional money needed, but also more capital would be needed to backfill the lost HTCs. Mark Feemster, financial adviser at Pinnacle Bank, points out that it “probably would have been cheaper to start from scratch,” but that the team was committed to rehabilitation.

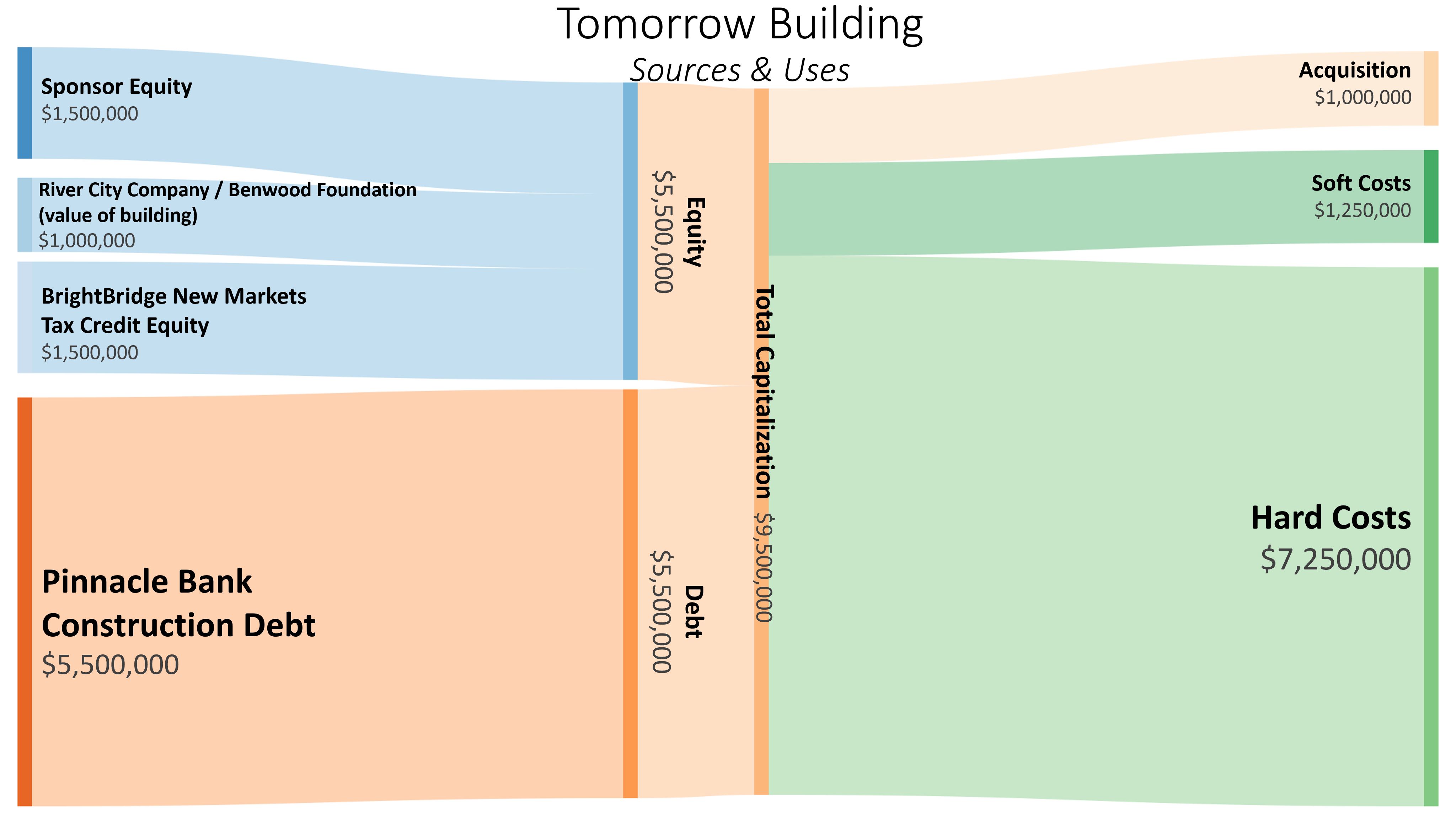

LPP had to recapitalize the project to rescue the deal. Instead of the RCC receiving a fixed price to sell the building, it accepted an equity stake in the project. Additional equity came from New Markets Tax Credits syndicated by a local community development financial institution (CDFI). “Those were incredibly complicated,” says Robinson, “but we decided to go for them once we figured out that our building would cost a whole lot more to rehab than we’d anticipated.”

Financial Overview

The $9.5 million final project budget was funded with a $5.5 million construction loan, $1.5 million from syndicated NMTC equity, $1.5 million in sponsor equity, and $1 million in the value of equity that RCC contributed.

Senior Lien

Lamp Post Group had a longstanding business banking relationship with Pinnacle Bank, so it was natural to turn to that bank for commercial real estate lending as well. Feemster says that the bank has had “a great working relationship with Lamp Post for about 10 years now. We’ve done a couple of other buildings for them, but none that required this much attention.”

As with any other novel product, Robinson put considerable effort into helping the lender understand “how viable the project was, since people were just starting to do multifamily projects again in downtown.” Co-living was especially unusual, since its all-inclusive prices were higher than market rents. Feemster says that the bank “had to look at it outside the box.” Robinson recalls, “I spent time helping the appraiser understand our rents, and everything that was included.” It certainly helped that LPP had its own experiment to point to, as well as guarantors.

The RCC also contributed with its downtown market study. White says that she “went to local banks and gave presentations to make sure they felt comfortable” with the idea of new rental apartments, priming their loan committees for future projects. Williamson says that “it helps bankers get over their apprehension, if they can see a third party that’s done a study that supports” the developer’s idea.

The coaxing paid off, with the building “appraising right at what we needed it to appraise at” to close the loan, says Robinson. Feemster also is pleased with the end result: “When I toured it, I was surprised that they could make it as functional as they did with the limited space. . . . It’s unbelievable what they’ve accomplished.”

Equity

“Getting [LPG’s principals] to buy into a historic rehab project wasn’t as hard as you think,” says Robinson, adding that “this building impacts their greater investment in these [early-stage] companies—which creates a better return for them” across the entire portfolio. From the perspective of a venture capitalist, this was the natural next step after launching a successful prototype. Its investors also have a long-term focus, says Robinson: “We have a mentality of a 10-year hold for all of our properties. . . . It has to do better than break even, but [our projects are] a long-term play.”

As the capital stack was rearranged to accommodate construction cost overruns, the RCC’s role in the project changed. White says, “It was more important for us to see the project take place than to get a cash return.” Instead of selling the building for a fixed acquisition price, the RCC contributed the building as an 8 percent equity stake in Ross Hotel Partners LLC, improving the debt-to-equity ratio.

That investment has already paid off in another regard, says White: “It got so much recognition” from the national press for downtown’s burgeoning startup ecosystem and the RCC’s efforts to develop a downtown innovation district. The Tomorrow Building has also been useful in establishing comparables, White continues: “We could tout that they don’t have parking, which gets developers a little more comfortable with not having one parking space per apartment. They also have great unique local retail, which has been really successful at animating the street.”

Public Financing

The RCC also introduced LPP to BrightBridge (River Gorge Capital), the largest community development entity in Tennessee, which made a New Markets Tax Credit (NMTC) equity investment in the building. To qualify, the building had to be not only mixed-use but also mixed-income, so 20 percent of units were set aside for low-income renters. Feemster says that “the NMTC enhancement took a project that maybe doesn’t make sense the traditional way, allowed them to keep the history and the building in place, and allowed us to underwrite the deal.”

However, Feemster warns that the NMTC has its drawbacks. “This was probably about the smallest deal we could have done based on the legal cost” of complying with its varied requirements, and that compliance costs valuable time as well: “Be prepared for a very deliberate and calculated closing process.” In this case, an extra two months of reviews were needed before closing.

The retailers also received signage grants available for small businesses in the area, and will benefit from a $2 million streetscape project underway on Patten Parkway.

Lessons Learned

Patient, local partners. The RCC and its foundation partners have strategically and patiently cultivated a decades-long regeneration of downtown Chattanooga, in collaboration with developer partners like LPP. Robinson points out that LPG’s local founders share that commitment: “Local wealth is definitely what’s going to keep recycling in your local ecosystem.”

Selling the vision. The RCC’s City Center Plan made sure that everyone was on the same page regarding reusing the Ross Hotel as rental apartments—from its foundation partners, to the building’s sellers, to its new buyers. The plan and its accompanying market study also helped to sell the same vision to local lenders. Amy Donahue, the RCC’s director of communications, says that “providing these tools that help a developer do something” has had a tremendous impact on downtown’s regeneration, even though the RCC’s facilitation of individual projects gets more attention.

Market intelligence. Both Lamp Post Properties and the River City Company had laid extensive groundwork for the Tomorrow Building, between the RCC’s feasibility studies and LPP’s prototype. These provided LPP with the confidence to forge ahead with the project even as it met difficulties. The property leased up in just six months, and “met the intangible goals we were hoping for on the retention side,” says Robinson. LPP is now searching for additional locations to bring its co-living and co-working concepts.

Project Information

| Project Timeline | |

|---|---|

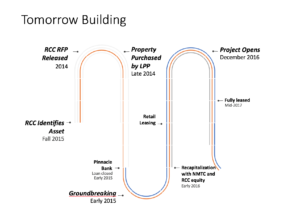

| Site purchased by River City Company | April 2014 |

| RCC releases RFP | 2014 |

| Site purchased by Lamp Post Properties | Late 2014 |

| Construction loan closed | Early 2015 |

| Groundbreaking | Early 2015 |

| Recapitalization with NMTC and RCC equity | 2015 |

| Opening | December 2016 |

Format

Deal Profiles

City

Chattanooga

State/Province

TN

Country

USA

Metro Area

Chattanooga

Project Type

Multifamily Rental

Location Type

Central Business District

Land Uses

Multifamily Rental Housing

Retail

Keywords

Adaptive use

Co-living

Co-working

Deal profiles

Dealprofiles

Downtown development catalyst

Downtown housing

Historic preservation

New markets

Regeneration

Tech-oriented tenants

Urban regeneration

Site Size

0.25

acres

acres

hectares

Date Started

2014

Date Opened

2016

Website

http://www.tomorrowbuilding.com

Address

818 Georgia Avenue

Chattanooga, Tennessee

Developer

Lamp Post Properties

Chattanooga, Tennessee

http://lamppost.properties

Architect

Artech Design Services

Chattanooga, Tennessee

Interviewees

Amy Donahue

Director of Marketing & Communications, River City Company

Mark Feemster

Financial adviser, Pinnacle Bank

Tiffanie Robinson

President/CEO, Lamp Post Properties

Kim H. White

President/CEO, River City Company

Jim Williamson

Vice President, Planning & Development, River City Company

Principal Author

Payton Chung