Format

Full

City

Denver

State/Province

CO

Country

USA

Metro Area

Denver

Project Type

Mixed Residential

Location Type

Central Business District

Land Uses

Bridge

Mixed Residential

Museum

Open space

Restaurant

Retail

Senior Housing

Keywords

Affordable housing

Healthy place features

Multifamily housing

Park

Pedestrian friendly

Public-private partnership

Revitalization

Single-family attached housing

Transit-oriented development

ULI Awards for Excellence 2011 Winner

Urban infill

Site Size

22.65

acres

acres

hectares

Date Started

1982

Date Opened

2001

Riverfront Park is an urban infill planned community that currently includes 1,859 rental and for-sale housing units in 14 buildings, 49,000 square feet of retail and restaurant space, a museum, and three parks on a 23-acre site adjacent to downtown Denver. The project was initiated by the city of Denver on former railroad land, and involved a firm that assembled and rezoned the land and a second partnership of firms that undertook much of the development and construction. The project is arranged in a linear fashion between railroad tracks on one side and a 19-acre park developed by the city on the other, and is connected to the downtown by an iconic pedestrian bridge that spans the railroad tracks.

Access to this robust content is a key benefit of ULI membership.

Become a member today to gain unlimited access to ULI Case Studies.

Become a Member Learn more about membershipThe Site | The Idea and Development Team | The Development and Approval Process | Development Finance | Planning and Design | Marketing, Leasing, and Management | Observations and Lessons Learned | Project Information

Riverfront Park is the result of a 25-year collaboration to create a viable and vibrant urban residential community in downtown Denver. Built under a form-based zoning code, the development encompasses 1,859 privately developed, for-sale, for-rent, and affordable homes, with buildings first opening in 2001 and with construction still underway in 2014. The neighborhood fits within the city’s grid and is connected to surrounding areas by four pedestrian bridges that cross railroad tracks, an interstate highway, and a river, each funded through a combination of public and private investment. Built on a brownfield and former rail yard, the project was an early model of sustainability. Today, residents can play, wander, skate, swim, and walk their dogs along dedicated nonvehicular pathways or in four different parks built by the state, the city, the developer, donors, and residents.

The Site

Denver was founded at the confluence of two quiet waterways, the South Platte River and Cherry Creek, where gold was first discovered in the Denver region. Over the city’s history, the waterfront has transitioned from an outpost to a boomtown to rail yards to a shantytown to a flood zone to a light-industrial park and now, finally, into a bustling downtown residential neighborhood. Just prior to redevelopment, the site was owned for many years by the Burlington Northern Railroad and included a huge rail yard and many tracks, as well as some old industrial warehouses that had to be demolished.

The Riverfront Park community and the adjacent Commons Park are located at the historic heart of Denver, at the confluence of these two rivers. The site, including the park, is bordered on the northwest by the South Platte River, on the southwest by Cherry Creek, on the southeast by the railroad lines and the Union Station project and downtown Denver (with two pedestrian bridges that span the tracks), and on the northeast by 20th Street, a major arterial. The site offers immediate access to Interstate 25 via two nearby freeway interchanges. The site also benefits from a recently added pedestrian bridge across I-25 that connects Riverfront Park with neighborhoods to the north.

The Idea and the Development Team

The idea behind the project emanated from several sources, including the city of Denver, which had a vision for redeveloping the railroad yards and adding parkland and new development to the area; Trillium Corporation, which bought the land from the railroad and worked with the city to plan and entitle the area for redevelopment; East West Partners (EWP), a resort developer that ultimately purchased the land and became the master developer for the project; and Crescent Real Estate Equities, which partnered with East West on development and provided critical equity financing to make the project happen.

The idea behind the project emanated from several sources, including the city of Denver, which had a vision for redeveloping the railroad yards and adding parkland and new development to the area; Trillium Corporation, which bought the land from the railroad and worked with the city to plan and entitle the area for redevelopment; East West Partners (EWP), a resort developer that ultimately purchased the land and became the master developer for the project; and Crescent Real Estate Equities, which partnered with East West on development and provided critical equity financing to make the project happen.

The idea and the vision for the project began during the 1980s with Mayor Federico Peña, who started a dialogue with the railroads about consolidating their railroad lines into fewer tracks, and redeveloping the excess land. In 1991, Trillium Corporation, led by its founder and chairman, David Syre, acquired several hundred parcels of land from Burlington Northern Railroad, including several excess parcels located in downtown Denver near the South Platte River that were no longer needed for railroad uses. The site that Trillium acquired included all of the land where Riverfront Park and Commons Park are located, as well as a partial interest in the adjacent Union Station parcel on the other side of the tracks.

At the same time, the city was hoping to start a redevelopment process in the area, following on the success that had been achieved in the LoDo area of downtown Denver. The city had been making plans for the area under both Mayor Peña and Mayor Wellington Webb, and this would continue under Mayor John W. Hickenlooper Jr. Notably, Mayor Webb took office in 1991, and one of his major goals was to build and improve the Denver park system, which led to the Commons Park idea.

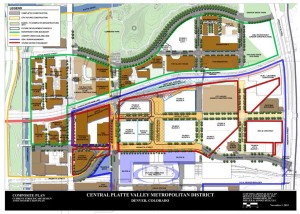

Once the railroads had consolidated the rail yard into a narrower channel and fewer tracks, Trillium brought in Design Workshop to help with a planning and design study to develop a concept plan and design guidelines for the newly available land. A public process was undertaken to prepare and execute a 21-block infrastructure and development plan. In the mid-1990s, a special district—the Central Platte River Metropolitan District— was established, and thereafter Trillium Corporation sold approximately 25 acres of land along the South Platte River to the city of Denver for the development of a new park, which was a part of that plan.

In 1996, Harry Frampton and Mark Smith of East West Partners, a resort development firm based in Beaver Creek, Colorado, heard the mayor of Denver speak at a ULI event in Denver about plans for the South Platte River area, and they subsequently decided to investigate the prospects for buying land and developing in the area.

In April 1999, East West Partners, together with the firm’s longtime equity partner, Crescent Real Estate, purchased 22.65 acres of entitled land from Trillium Corporation and began the process of redeveloping that site into what is now called Riverfront Park. One of the main reasons they were attracted to the property was the Commons Park. Their vision for the project, while similar to the city’s vision, was framed by their experience as resort developers. They had spent much of their careers developing resort communities and mixed-use villages oriented around mountain and ski amenities. Riverfront Park, they believed, could be thought of in a similar fashion, but with the city and the nearby Commons Park and Platte River as the amenities. Their objective was to create a quiet urban residential neighborhood with easy access to the urban park and downtown Denver. To a certain degree, they thought of the project as an urban resort.

The Development and Approval Process

One of the first public entities that was set up to engage in the redevelopment process was the South Platte River Commission, which was established in 1995 with a charge to “[c]reate partnerships among local, state, and federal agencies, [and] private and nonprofit sectors to plan and fund needed improvements” to the South Platte River Valley. The commission was also charged with arranging funding for the various projects in the area, including the parks and the bridges that were envisioned.

Mayor Webb and the commission eventually arranged a deal with Trillium in which the city would flip land with Trillium such that the city would acquire the land next to the river, in exchange for making infrastructure improvements, including new roads and bridges and a new park. Notes Mayor Wellington, “I wanted parks to be my legacy, and I saw parks as a value-driven investment—an investment that would enhance surrounding areas.” The city also had to invest considerable dollars to remediate the railroad land, which had been contaminated with coal ash over the years.

In 1997, the city government and the County of Denver Planning and Development Office, together with Trillium Corporation and Design Workshop, released a plan and urban design standards and guidelines for the area that was then called the Commons. These guidelines laid out a plan that addressed streetscape and landscape design, vehicular circulation, blocks and zone lots, a pedestrian active use requirement, setbacks and build-to requirements, architectural scaling, building materials and fenestration, entries, roofs, parking garages, and signage. This plan included a planned unit development (PUD) ordinance, and essentially provided an entitlement to develop according to the plan, but with considerable flexibility. The PUD ordinance was very flexible in terms of a mix of residential and retail uses. It was generally a form-based code, which meant that it generally did not prescribe uses, although it did include deed restrictions that disallowed office space for a number of years, essentially eliminating office uses from the project.

In the course of developing the plan, Trillium set aside more than 20 acres for the centerpiece park, swapped land to relocate a public service company transfer station and acquire access to the valuable Cherry Creek bike bath, and negotiated other strategic property and tenant deals before selling the land to East West.

Development Finance

The financing and financial plan for the project was very much an exercise in phasing, timing, patience, selling land parcels, and preselling residential units. The land was originally acquired by Trillium Corporation for around $1.50 per square foot. The company subsequently sold land for the park to the city for around $5 per square foot, with the city promising to build the park and provide infrastructure to make the entire project viable. Trillium thereafter sold most of the remaining Riverfront Park land to East West Partners and Crescent Real Estate for $25 per square foot.

At the outset, East West Partners and Crescent had established a deal in which Crescent put up the equity for the land, and East West managed the development and provided sweat equity as the project proceeded. A land loan was also arranged with Bank of America, but the land was mostly paid for with equity from Crescent, a patient investor, allowing the project to proceed without undue pressure or large carrying costs. As the development proceeded, profits were split, with 64 percent going to Crescent and 36 percent going to East West. Crescent received a preferred return, and got paid first.

The financing strategy also involved selling some of the parcels to other developers, often apartment developers, including two parcels sold early on—one to Greystar Partners for the Manhattan (completed in 2003) and one to Archstone-Smith for Station at Riverfront Park (completed in 2004). These early parcels sold for around $45 per square foot, providing working capital to start other buildings in the project. In later phases, parcels were sold to Balfour Homes and AMLI Residential, a multifamily real estate investment trust. This allowed East West and Crescent to recoup capital as the value of the properties grew with the evolving development. Recently sold parcels have gone for more than $200 per square foot. The most recent parcel of land that was sold—which is actually part of the nearby Union Station project—went for around $300 per square foot.

Each building within the project was financed separately. The first building, Riverfront Tower, cost $46.2 million to develop and was financed with a $29 million loan from Bank of America, $5.9 million of equity from East West Partners and an EWP fund, and $11.3 million in sales revenue and deposits for the condos. A similar financing arrangement was used for Promenade Lofts, the second building to be completed. But for Park Place Lofts, the third building to be financed, the developer was able to finance $24 million of the $34.7 million development cost through sales revenue and deposits, greatly reducing the debt load and interest costs for that building.

For the Creekside Lofts development, Bank One provided $6.3 million in debt and Crescent provided $2.6 million in equity, with the remainder of development costs financed via sales revenue. One Riverfront used a similar debt/equity/sales strategy, with Vectra and CB&T providing debt.

The largest and most expensive building in Riverfront Park—the Glass House—cost just under $90 million and was financed as an apartment building, even though it was developed as a condominium. This project was undertaken jointly by East West Partners and Wood Partners. Debt funding of $67 million was provided by Bank of America, and equity funding of $22.5 million was provided by Secured/Blackrock.

In 2007, Crescent sold much of its interest in the project to Morgan Stanley just prior to the financial crisis, and Morgan Stanley subsequently lost its interest in the project to the lender, Barclays, which then brought Crescent back into the deal to manage Barclays’ interests.

East West and Crescent also partnered with Urban Ventures to provide 56 affordable housing units within the project, which are mixed in throughout the development, including six units in Riverfront Tower and seven units in Park Place Lofts. Apartment developers in the project built all of the affordable rental units.

Planning, Design, and Phasing

The overall plan and design have been shaped by two critical infrastructure elements that were essential to making the project work. One was the aforementioned Commons Park, the first element that was planned and built, developed by the city. This park includes a pedestrian bridge over the South Platte River, connecting the project with neighborhoods to the north. The park created a highly desirable amenity directly adjacent to the project, greatly enhancing the views from the residences and providing active open space for a variety of recreational activities. The park was designed by Civitas, and the design sought to preserve approximately 40 percent of the site in native habitat, including aquatic, wetland, riparian, and upland communities. Landscape features include hills, open fields, overlooks, pathways, and walls.

The second element was a pedestrian bridge over the railroad tracks—Millennium Bridge, completed in 2002—that aligns with the 16th Street pedestrian mall in downtown Denver and also connects the project to the Union Station area. The bridge, which cost $11 million to build, was partly funded by the developers, who also oversaw the design to ensure that the bridge would be a prominent iconic structure that could attract attention and draw pedestrians to the area. The developer was able to champion a more creative and striking design that has become a landmark—a feat that was partially accomplished by agreeing to cover any construction cost overruns for the bridge construction.

The plan organizes all of the buildings between these two major elements—the bridge over the railroad tracks and Commons Park—and most of the buildings and parcels are located along one main curvilinear street—Little Raven Street—that runs along the edge of Commons Park. Several streets, in turn, run roughly perpendicular to Little Raven to create a street grid system—including 15th Street, 16th Street, 18th Street, and 19th Street—that aligns with downtown streets on the other side of the tracks. Two of these streets terminate at the railroad tracks, while 16th and 18th streets connect to pedestrian bridges. The plan also includes three smaller parks and a museum.

Once the Commons Park was underway, East West Partners began construction on the core area of Riverfront Park; construction on the Millennium Bridge commenced after the buildings were started. The plan started with 197 condo units in three buildings arranged around a plaza and retail area, located between the pedestrian bridge and the Commons Park, creating an immediate sense of place for Riverfront Park. These structures—including the 61-unit Riverfront Tower, the 66-unit Promenade Lofts, and the 70-unit Park Place Lofts—were completed in 2001–2002, a tough time in the market following the events of September 11, 2001. The buildings also included a coffee shop, a casual restaurant, and a fine-dining destination restaurant, adding further to the vitality of the initial elements. These restaurant and retail elements remain the core retail elements for the entire project, which is largely residential.

The architecture of the first three buildings used traditional Denver materials, including brick, granite, and sandstone, but in a modern design, with structural steel as the primary structural element. Special foundation layering techniques were used to mitigate noise and vibration from the nearby trains. One of the buildings offers an entrance directly from the upper level of Millennium Bridge.

The fine-dining restaurant, Zengo, is located in the Park Place Lofts building on Little Raven Street facing the Commons Park, and has become a destination and a key marketing element for the project, a signature element that helps to identify the new district. Many local residents may not know of Riverfront Park, but they often do know the name of the restaurant and its location. The more casual restaurant, McLoughlin’s, is located in the Promenade Lofts building on 16th Street near the Millennium Bridge. The coffee shop is located in the Riverfront Tower and also faces the Commons Park on Little Raven Street. There also is a dry cleaner and a dentist office in the retail component. Notes Harry Frampton of East West, “The restaurants were very important for creating a sense of place in this emerging location, especially the destination restaurant.”

As noted, one of the parcels on the west side of the plan that was sold to Archstone-Smith was developed into the Station at Riverfront Park, including 273 apartments in a four-story configuration along 15th Street, stretching from Little Raven Street to the railroad tracks. Another parcel along the railroad tracks on the east side of the plan was developed by Greystar Corporation, which built the Manhattan, a 265-unit high-rise rental apartment building, in 2003.

These additions created a district that in the early phase featured three central buildings and two flanking projects on either side, with open land in between.

In 2005, several projects were added on the west side of the project near Cherry Creek, including the Delgany and the Creekside Lofts (condos), and these were followed by Creekside Townhomes in 2006. On the east side, the Brownstones at Riverfront were completed in 2005, featuring 16 high-end townhomes. Townhouses and brownstones had not been built much in downtown Denver before those added to Riverfront Park, but they turned out to be very successful projects.

Also, in 2006 the Museum of Contemporary Art was added to the neighborhood, located just up the street from Creekside Loft and across the railroad tracks at 15th Street and Delgany on the downtown side of the railroad tracks. This parcel had been sold to Continuum Partners, which donated the land to the museum and also developed the Art House Townhomes on the property.

One Riverfront, located just to the east of the original core area, was added to the plan in 2007. In 2008, the crown jewel—the Glass House—was completed. This signature project consists of two 23-story glass towers rising from an eight-story base and includes 390 condo units. It was sited along the railroad tracks between the Millennium Bridge and the Manhattan, and offers spectacular views of both downtown Denver and the Commons Park. Unlike most other buildings in the project, the Glass House features extensive glass curtain walls, offering light-filled units that are generally smaller than those in other buildings in Riverfront Park.

The most recent additions are the Park at One Riverfront, featuring 18 townhouses facing Commons Park, completed in 2010; the Cosmopolitan Club, a 264-unit seniors’ housing project being developed by Balfour on the west side, set for completion in 2014; and AMLI Riverfront, a five-story rental housing project located on a parcel sold to and being developed by AMLI Residential at the corner of 19th and Little Raven streets.

At present, 14 residential projects have been developed within Riverfront Park, with two additional parcels remaining to be developed that will include around 300 residential units.

While the Commons Park is the most important park amenity for Riverfront Park, the plan also includes three other parks: Confluence Park Plaza on the west side along Cherry Creek, the Denver Skatepark on the east adjacent to 20th Street, and the Railyard Dogs Park, also on the east side adjacent to the AMLI Riverfront project and the railroad tracks on 19th Street. The dog park actually came about as a result of dog owners in the community coming together because they were not allowed to use Commons Park as a dog park. The skate park has become a very popular venue and also offers an attractive alternative for skateboarders who might otherwise be using the other parks and plazas for skateboarding.

A second bridge spanning the railroad tracks at 18th Street was added in 2010, connecting Riverfront Park directly to the emerging Union Station neighborhood.

Marketing, Leasing, and Management

The Commons Park has been billed as Denver’s Central Park, and Riverfront Park is strongly marketed and positioned to take advantage of this location and amenity, starting with the historical name Riverfront Park. Riverfront Park thus has also been carefully positioned as a quiet neighborhood adjacent to both open space and the amenities of downtown Denver.

Marketing and sales. When the project first got underway, the developers established a sales center across town in the fashionable Larimer Square area, with the idea that visitors to that popular district might be intrigued by what was being developed at Riverfront Park. The center featured a model of the Riverfront Park development and nearby downtown areas. The model has been updated as new buildings have been added, including the addition of the Union Station project across the tracks in downtown Denver. The model has helped tremendously in showing the overall scope of the project, and the marketing staff has used the model to help buyers understand the vision for the project and its relationship to surrounding elements. As of 2014, the model is still being used in the marketing center within Riverfront Park to market both Riverfront Park and the adjacent Union Station project. This model was especially critical in the early phases, when all that existed on site was the park, the bridge, and three buildings under construction. East West also marketed the project to buyers and owners in the firm’s resort communities, some of whom wanted to establish urban residences as well.

Another critical marketing element in later phases was the Zengo restaurant, which the developer invested in at the outset to create a new destination that would draw visitors and potential homebuyers to the area. Because of the restaurant, notes Mark Smith of East West, “We were able to achieve rents that we would not have gotten otherwise.”

The first phase of residential sales attracted empty nesters, young professionals, and mountain homeowners seeking city addresses, and pricing escalated throughout the first year of sales, when three buildings were offered for sale. The first building—Riverfront Tower—includes one-bedroom units of 1,222 square feet that sold for $393,156, approximately $322 per square foot; larger penthouse units sold for around $385 per square foot. One-bedroom units in the Promenade Lofts—the second building to be completed—sold for slightly more, around $353 per square foot; the third building, Park Place Lofts, sold for even higher rates, with one-bedroom units selling for $399 per square foot. Affordable units in the first phase were priced in the range of $180,000 to $190,000. Sales prices for other new residential projects in the downtown LoDo district were $165 per square foot or less at the time Phase I began at Riverfront Park.

The next phase of for-sale product came on line in 2003, with one-bedroom units at the Creekside Lofts I selling at a lower price point of $307 per square foot. Following this, the Delgany came on line in 2005 with loft units selling for $425 per square foot, and Creekside Lofts II with one-bedroom unit sales at $399 per square foot.

Sale prices ramped up with the Brownstones at Riverfront, first offered in 2004 and completed in 2005. These 3,096-square-foot luxury townhouses sold for around $1.6 million each—about $516 per square foot, a new high for the project. The Brownstones at Riverfront project was able to tap into a luxury market that had not been attempted prior to this at Riverfront Park. One Riverfront, completed in 2007, was nearly as successful, achieving sales prices of $478 per square foot for the 43 lofts offered there.

The most iconic building in the project is the Glass House, which includes 389 residences and was built in partnership with Wood Partners. Construction was started in 2005 and completed in August 2008; sales began in June 2006, and the units sold out in 45 days, just prior to the national housing downturn and financial crisis that followed. Prices for one-bedroom units were around $350 per square foot. The units here are smaller and more affordable, but include large glass windows and are located in a striking glass building that is the most prominent building in the project. The building contains a vast variety of units, including 73 floor plans. Parking ratios were set at one space per bedroom. The Glass House also includes a health club in the base building. Wood Partners took on much of the responsibility for managing the construction phase of this project. While the per-square-unit prices were lower than those in other projects, the Glass House was financially the most successful element in Riverfront Park, achieving total sales of $138.5 million with development costs of only $90 million.

The Park at One Riverfront was the one element in the project that was affected by the 2008 financial crisis. Construction started in May 2007 and the project was completed in July of 2010. Although this project took much longer to sell out than the previous projects, it achieved attractive unit pricing. Fortunately, there were only 18 units to be sold, and two-bedroom units ultimately sold for good prices, going for as high as $866,083, or $550 per square foot.

Retail space has achieved rents generally in the range of $28 per square foot.

Community foundation. A key element in the ongoing evolution of the neighborhood is the Riverfront Park Community Foundation. The foundation is a not-for-profit entity with the simple goal of incubating arts and education programs throughout the city, and funding projects that improve the lives of downtown residents and workers.

The entirety of the foundation’s funding comes from the residents of Riverfront Park through a transfer fee assessed on every sale of developed real property in the neighborhood. Currently set at 0.5 percent of the sales price, the assessment generates, on average, more than $300,000 in revenue per year. Funding has been provided to complete projects within the neighborhood: the construction of the dog park, the preservation of a wetland, and the installation of art. Grants have also been used to incubate after-school programs, support art exhibits, fund community health initiatives, and support cultural programming.

The program that best demonstrates the foundation’s mission is PlatteForum, located in the ground-level space of the Park Place Lofts building. Founded with an initial $50,000 grant, PlatteForum is a ten-year-old organization that brings artists into its studio space for extended residencies. During that time, those artists work with at-risk children and young adults. Students receive a real-world art experience and a chance to build confidence and express their individuality. Over 1,000 kids have worked at the studio in all of its programs, the students’ art is in permanent exhibitions throughout the city, and the program has become a model for others like it all over the country. It recently received the National Award for Leadership in the Arts and Humanities, awarded by Michelle Obama.

Management and associations. The Riverfront Park Master Association and East West Urban Management provide oversight for the whole community, including additional security, neighborhood cleaning services, landscape services, property management services, concierge services, and rental management for condos that are offered for rent. The master association provides governance of the individual homeowner and condo associations.

Observations and Lessons Learned

Over 2,500 people now live in the Riverfront Park neighborhood, with 1,044 rental units and 815 ownership units completed or under construction. About 10 percent of residents live in affordable homes. With a large project like this, a wide variety of product is required to achieve a reasonable rate of absorption. Notes Chris Frampton of East West, “There is no one buyer profile. It is not a demographic that we sell to, but rather a psychographic.” There are many buyer types in a variety of price ranges within Riverfront Park, but they all have one or two things in common: they either like urban living and the amenities offered by the city, or they like living next to parks and open space. Or they like both.

One of the lessons that East West learned early on was that its unit pricing was a bit on the high side, having been framed by the company’s experiences in its mountain resorts where East West had been able to obtain very high prices. A consultant advised the company that it needed to offer more moderately priced units if it hoped to achieve its financial goals, and this was what led to the Glass House building, one of the most successful buildings in the project.

Essential to a phased large-scale project like this is a knowledgeable landowner and financial partner that understand that investing in infrastructure upfront is critically important—and that patience is required, because much of the profits in such a project are achieved at that end, when appreciation reaches its maximum and major infrastructure investment costs are far in the past.

As of early 2014, more than $413 million in home sales have been completed at Riverfront Park, with development costs for these buildings totaling $339.5 million, providing net income of $73.6 million thus far to the development partnership for the development of the for-sale products. Substantial additional revenue has also been achieved via the sale of four land parcels, while additional costs have been incurred to build infrastructure, including the bridges and the three parks within the project. Per-square-foot home prices are substantially higher than those in many adjacent neighborhoods, and per-square-foot rental rates and occupancy percentages are in the top 5 percent in the metropolitan area.

Riverfront Park has been especially successful in contributing to the creation of a new pedestrian corridor within Denver via the addition of pedestrian bridges over rivers, railroads, and highways. The value of pedestrian-oriented infrastructure should not be underestimated. The four pedestrian bridges—over the railroad tracks, the Platte River, and I-25—that now connect the downtown with Riverfront Park and neighborhoods to the northwest have been transformative for the city and are heavily used by walkers, bikers, and joggers alike. This pedestrian pathway has become a recreational and pedestrian magnet set apart from the traditional road infrastructure. It has greatly contributed to encouraging nonvehicular travel patterns within the Denver core, making the city a greener, healthier, and more attractive place to live and visit.

Riverfront Park has also demonstrated the transformative power of public/private collaboration. Success at Riverfront Park involved the cooperation and/or shared vision of many entities, including the railroads that agreed to consolidate their tracks and sell the land, a strong city vision and commitment to investing in parks and infrastructure and pedestrian amenities, a visionary land investor who helped shape a new plan for the area, and a creative development partnership that was willing to take the risk to invest in an innovative large-scale redevelopment effort, creating a new urban neighborhood “on the other side of the tracks” that has expanded and enriched Denver’s urban core.

Project Information

| Development Timeline | |

|---|---|

| Mayor Federico Pena delivers the Imagine a Great City speech that launches the effort to redevelop the Riverfront Park area. | 1982 |

| Trillium Corporation acquires the Riverfront Park site. | 1991 |

| Riverfront Park master plan completed and city agrees to form metro district to fund required improvements. | 1997 |

| East West Partners agrees to buy 23 acres of land from Trillium using a four-page purchase and sale agreement. | 1999 |

| East West Partners commences design of first three buildings (Riverfront Tower, Promenade Lofts, and Park Place Lofts) in Riverfront Park. | 2000 |

| Riverfront Park Community Foundation formed using a 0.5 percent transfer assessment on all properties in Riverfront Park. | 2000 |

| Sales launched for Promenade Lofts and Park Place Lofts. | 2000 |

| Riverfront Park Master Association is formed. | 2001 |

| Completion and initial closings for Riverfront Tower, Promenade Lofts, and Park Place Lofts. | 2001 |

| Land is sold to Archstone-Smith and Greystar. | 2001 |

| The 19-acre Commons Park along the South Platte River opens to the public. | 2001 |

| Initial closings for Riverfront Tower begin. | 2002 |

| Mayor Wellington Webb officially opens the $11 million Millennium Bridge connecting Riverfront Park to the rest of downtown Denver. | 2002 |

| PlatteForum is founded to address diminishing access to the arts in public schools and to provide a place for artists to work with children. | 2002 |

| The Manhattan apartments are completed by Greystar. | 2003 |

| The Platte River Bridge is completed. | 2004 |

| Archstone completes the Station at Riverfront Park apartments. | 2004 |

| The Delgany, Creekside Lofts I and II, and the Brownstones at Riverfront are completed. | 2005 |

| The Creekside Townhomes are completed. | 2006 |

| The Museum of Contemporary Art opens. | 2006 |

| One Riverfront is completed. | 2007 |

| The Highland Bridge over Interstate 25 is completed. | 2007 |

| The Glass House is completed. | 2008 |

| The Park condominiums are completed. | 2010 |

| Railyard Dogs Park opens. | 2010 |

| The 18th Street Bridge is completed. | 2010 |

| Balfour Senior Living breaks ground on the Balfour at Riverfront Park. | 2013 |

| AMLI Riverfront opens. | 2014 |

| Land Use Information | Area (acres) | Percentage of site |

|---|---|---|

| Buildings | 14.30 | 63 |

| Street/surface parking | 5.51 | 24 |

| Landscaping/open space | 2.20 | 10 |

| Other | 0.64 | 2 |

| Total | 22.65 | 100 |

| Gross Building Area | Area (sq ft) | Units |

|---|---|---|

| Residential | 1,126,431 | 1,859 |

| Retail | 48,553 | |

| Parking | 513,465 | |

| Total | 1,688,449 |

| For-Sale Housing Information | Number of units | Unit size (sq. ft.) | Sales price range | Completed | Total sales |

|---|---|---|---|---|---|

| Riverfront Tower | 61 | 863-3,329 | $393,156-$1,283,260 | 2001 | $45,213,352 |

| Promenade Lofts | 66 | 885-4,149 | $365,000-$1,464,330 | 2001 | $30,193,292 |

| Park Place Lofts | 70 | 751-4,528 | $299,855-$1,808,519 | 2001 | $40,885,902 |

| The Delgany | 42 | 1,594 | $678,697 | 2005 | $28,505,260 |

| Creekside Lofts I | 40 | 898-1,164 | $276,017-$451,900 | 2005 | $14,449,800 |

| Creekside Lofts II | 40 | 838-1,157 | $335,092-$504,594 | 2005 | $16,465,700 |

| Brownstones at Riverfront | 16 | 3,096 | $1,596,198 | 2005 | $25,539,167 |

| Creekside Townhomes | 23 | 2,711 | $779,913 | 2006 | $17,937,999 |

| One Riverfront | 50 | 1,430-2,373 | $683,701-$1,384,500 | 2007 | $39,090,627 |

| Glass House | 389 | 865-1,383 | $283,600-$469,177 | 2008 | $138,528,104 |

| The Park | 18 | 1,574-2,068 | $775,267-$1,028,367 | 2010 | $16,331,400 |

| Glass House | 389 | 865-1,383 | $283,600-$469,177 | 2008 | $138,528,104 |

| Total developed by East-West | 815 | $413,140,603 |

| Rental Housing Information | Number of units | Completed | Developer |

|---|---|---|---|

| Station at Riverfront Park | 273 | 2002 | Archtone-Smith |

| Manhattan | 265 | 2003 | Greystar Corporation |

| AMLI Riverfront | 242 | 2014 | AMLI Residential |

| Cosmopolitan Club | 264 | 2014 | Balfour Senior Care |

| Total | 1,044 |

| Retail Information | Area (sq. ft.) | Rent per sq. ft. |

|---|---|---|

| Riverfront Tower | 18,004 | $28 |

| Promenade Lofts | 6,545 | $28 |

| Park Place Lofts | 18,004 | $28 |

| Glass House | 6,000 | |

| Total | 48,553 |

| Public Amenities |

|---|

| Confluence Park Plaza |

| Commons Park (city park) |

| Denver Skatepark |

| Railyard Dogs Park |

| Museum of Contemporary Art |

Development Cost Information By Phase

| First Phase Projects | Total for all condo projects | Riverfront Tower | Promenade Lofts | Park Place Lofts |

|---|---|---|---|---|

| Site acquisition cost | $11,004,418 | $619,995 | $586,501 | $945,573 |

| Site improvement costs | ||||

| Excavating/grading | $1,101,524 | -- | -- | -- |

| Landscaping/irrigation | $1,180,275 | -- | $112,636 | $208,821 |

| Other | $4,710,505 | $130,685 | $374,602 | $477,361 |

| Total | $6,992,304 | $130,685 | $487,238 | $686,182 |

| Construction costs | ||||

| Retail | $4,513,893 | $1,062,347 | $885,735 | $2,565,811 |

| Residential | $225,711,899 | $30,487,617 | $20,446,939 | $22,469,149 |

| Total | $230,225,792 | $31,549,964 | $21,352,674 | $25,034,960 |

| Soft costs | ||||

| Architecture/engineering | $17,975,070 | $2,254,986 | $1,789,193 | $2,412,343 |

| Project management | $11,704,739 | $1,491,653 | $1,089,340 | $1,683,229 |

| Marketing | $8,912,612 | $789,552 | $532,632 | $547,281 |

| Legal/accounting | $3,421,136 | $551,276 | $378,816 | $561,004 |

| Taxes/insurance | $1,675,323 | -- | -- | -- |

| Construction interest & fees | $5,806,985 | $1,057,962 | $568,983 | $893,598 |

| Other | $41,792,466 | $7,841,497 | $1,967,853 | $1,893,828 |

| Total | $91,288,332 | $13,986,926 | $6,326,817 | $34,657,998 |

| Total development costs | $339,510,846 | $46,287,570 | $28,753,230 | $34,657,998 |

| Middle Phase Projects | The Delgany | Creekside Lofts I | Creekside Lofts II | Brownstones | Creekside Townhomes |

|---|---|---|---|---|---|

| Site acquisition cost | $1,047,066 | $526,000 | $656,000 | $1,059,147 | $811,090 |

| Site improvement costs | |||||

| Excavating/grading | -- | $327,000 | $327,000 | $457,524 | -- |

| Landscaping/irrigation | $379,517 | -- | -- | -- | -- |

| Other | $600,043 | -- | -- | $623,064 | $1,394,317 |

| Total | $979,560 | $327,000 | $317,000 | $1,080,588 | $1,394,317 |

| Construction costs | |||||

| Retail | -- | -- | -- | -- | -- |

| Residential | $13,252,212 | $7,219,000 | $7,750,000 | $15,507,974 | $7,744,937 |

| Total | $12,252,212 | $7,219,000 | $7,750,000 | $15,507,974 | $7,744,937 |

| Soft costs | |||||

| Architecture/engineering | $1,199,365 | $1,148,000 | $728,000 | $1,470,521 | $348,283 |

| Project management | $863,258 | $1,037,000 | $516,000 | $1,058,000 | $1,115,576 |

| Marketing | $1,027,388 | $554,000 | $404,000 | $1,109,381 | $611,926 |

| Legal/accounting | $385,536 | $273,000 | $227,000 | $267,000 | $215,682 |

| Taxes/insurance | -- | $283,000 | $220,000 | -- | -- |

| Construction interest & fees | $343,547 | $98,000 | $115,000 | $635,977 | $296,528 |

| Other | $3,092,636 | $185,000 | $96,000 | $2,693,702 | $171,920 |

| Total | $6,911,730 | $3,578,000 | $2,306,000 | $7,234,581 | $2,759,915 |

| Total development costs | $22,190,568 | $11,722,000 | $11,029,000 | $24,882,290 | $12,710,259 |

| Later Phase Projects | One Riverfront | Glass House | The Park |

|---|---|---|---|

| Site acquisition cost | $1,236,342 | $3,094,400 | $395,304 |

| Site improvement costs | |||

| Landscaping/irrigation | $479,301 | -- | -- |

| Other | $961,034 | -- | $149,399 |

| Total | $1,440,335 | -- | $149,399 |

| Construction costs | |||

| Residential | $21,335,877 | $68,118,000 | $11,288,194 |

| Total | $21,335,877 | $68,118,000 | $11,288,194 |

| Soft costs | |||

| Architecture/engineering | $3,380,292 | $2,360,000 | $884,087 |

| Project management | $1,175,026 | -- | $1,675,657 |

| Marketing | $1,953,204 | -- | $1,383,249 |

| Legal/accounting | $328,822 | -- | $233,000 |

| Taxes/insurance | -- | -- | $1,172,323 |

| Construction interest & fees | $1,238,649 | -- | $558,741 |

| Other | $7,448,248 | $16,401,782 | -- |

| Total | $15,542,241 | $18,761,782 | $5,907,057 |

| Total development costs | $39,563,795 | $89,974,182 | $17,739,954 |

Format

Full

City

Denver

State/Province

CO

Country

USA

Metro Area

Denver

Project Type

Mixed Residential

Location Type

Central Business District

Land Uses

Bridge

Mixed Residential

Museum

Open space

Restaurant

Retail

Senior Housing

Keywords

Affordable housing

Healthy place features

Multifamily housing

Park

Pedestrian friendly

Public-private partnership

Revitalization

Single-family attached housing

Transit-oriented development

ULI Awards for Excellence 2011 Winner

Urban infill

Site Size

22.65

acres

acres

hectares

Date Started

1982

Date Opened

2001

WEBSITE

East West Urban Management

Slifer Smith & Frampton Denver, Inc.

PROJECT ADDRESS

Riverfront Park

1600 Little Raven Street

Denver, Colorado 80202

MASTER DEVELOPER

East West Partners

Denver, Colorado

303-623-1500

ewpartners.com

EQUITY INVESTMENT PARTNER

Crescent Real Estate Holdings LLC

Fort Worth, Texas

crescent.com

LAND ASSEMBLY AND ZONING APPROVALS

Trillium Corporation

Bellingham, Washington

www.trilliumcorp.com

MASTER PLANNER

Design Workshop

Denver, Colorado

designworkshop.com

DEVELOPMENT PARTNERS

Archstone-Smith

Greystar Partners

Wood Partners

Continuum Partners

Urban Ventures

NOT-FOR-PROFIT/PHILANTHROPIC DEVELOPMENT PARTNERS

Greenway Foundation

Railyard Dogs

Denver Museum of Contemporary Art

BUILDING ARCHITECTS

42ǀ40 Architecture

Oz Architecture

Preston Partnership

Humphries Poli Architects

BRIDGE ARCHITECTS

Architecture Denver

COMMONS PARK PLANNER

Civitas, Inc.

MUSEUM ARCHITECT

David Adjay