Format

Deal Profiles

City

Portland

State/Province

OR

Country

USA

Metro Area

Portland

Project Type

Mixed Use

Location Type

Other Central City

Land Uses

Multifamily Rental Housing

Retail

Keywords

Affordable housing

Crowdfunding

Deal profiles

Dealprofiles

Housing for the homeless

Mixed-Income Development

Single-room-occupancy housing

Small-scale development

Site Size

0.11

acres

acres

hectares

Date Started

2017

Date Opened

2019

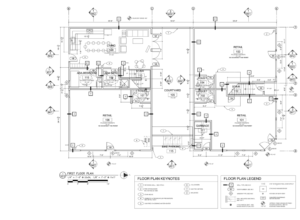

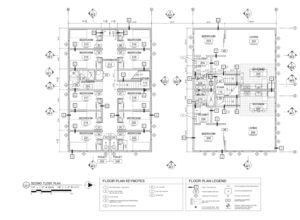

Jolene’s First Cousin is a two-story, 6,600 square foot retail and residential building in Portland, Oregon with three small retail spaces, two one-bedroom apartments, and 13 bedrooms leased to a transitional housing service provider. Its equity investors, both accredited and unaccredited, accepted a lower current return in order to contribute to the building’s social mission.

The Site and Neighborhood

Jolene’s First Cousin (JFC) is located on the corner of SE Gladstone Street and SE 28th Place in Creston-Kenilworth, amid a 1930s neighborhood of bungalows and streetcar retail about two miles (3.2 km) southeast of downtown Portland. It sits between trendy SE Division Street and Reed College. Guerrilla Development was renovating a dilapidated old bar on Gladstone, and a house went up for sale a block over, on a corner lot already zoned for mixed use.

Anna Mackay, director of development at Guerrilla, said that buying the house for $500,000 was an easy decision. Its underlying value was in the land; although the team had aspirations of moving the original Victorian on the site, the logistics proved too costly. They had the original house deconstructed board by board and salvaged.

Besides being a promising market, the area was “one of most progressive, accepting, down-to-experiment pockets I’ve come across. I can’t say that we planned that, but the neighborhood has been so rad,” says Mackay. “We were frankly expecting more controversy,” says Guerrilla’s owner and founder, Kevin Cavenaugh.

The Initial Idea

Guerrilla Development is well known around Portland for  developing small but eye-catching retail, office, and live/work buildings. Many of its smaller retail tenants are restaurants that began in one of the city’s well-known food cart corrals, then graduated into one of the carefully curated mini–food halls that Guerrilla has developed.

developing small but eye-catching retail, office, and live/work buildings. Many of its smaller retail tenants are restaurants that began in one of the city’s well-known food cart corrals, then graduated into one of the carefully curated mini–food halls that Guerrilla has developed.

While ruminating on what to do with the JFC site, Mackay says that “we, as developers, were scratching our heads about how we could begin to make a dent in the systemic problem” of homelessness. Not long after closing on the property, the county’s biennial

census of unsheltered residents found a 10 percent increase in residents experiencing homelessness.

That spurred the idea to incorporate a small single-room-occupancy (SRO) space behind the three retail spaces and two apartments at JFC. The SRO component would fill 40 percent of the structure, with a common kitchen, a lounge area, bathrooms, and laundry. Having a “mix allows us to internally subsidize the SRO” and keep per-bed rents down, says Mackay. Pricing was set at just $425 per bed, fully furnished—though because of its size (13 bedrooms), the SRO is still the largest tenant on the building’s rent roll. Both the SRO component and the two-story project are “at a scale that could nestle into any neighborhood in Portland.” Local zoning allowed the SRO by-right, as it was considered a “group living” use.

The Idea Evolves

The initial idea was to offer some of the SRO units via a social service agency, while others would be rented out on the open market. Mackay says that they soon realized that “we are experts in design and real estate, not social workers. . . . Our job is to build beautiful space and offer it at a very competitive price, and then get smarter people to take on” management.

Late in the process, Mackay says, “We were lucky to partner with JOIN,” a housing nonprofit organization with 25 years of experience in offering transitional housing and wraparound services, “who will take on a master lease and the task of creating a harmonious community of folks. Beyond space, they can offer the network of support that they offer every person they re-home.”

Financial Overview

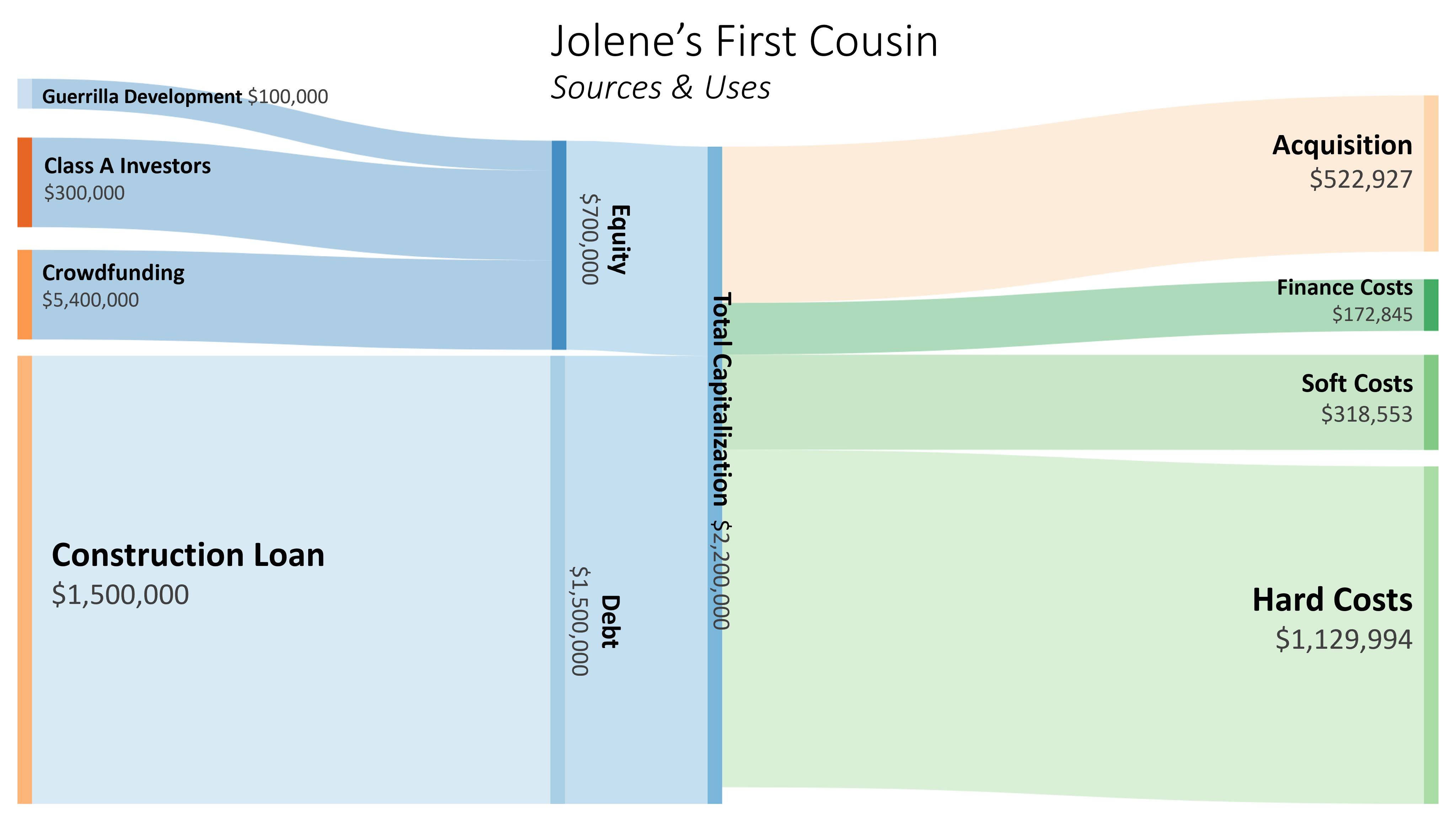

The unconventional program at JFC was supported in part  by an unconventional source: a directly crowdfunded offering of preferred equity to local investors, which covered 14 percent of the total project budget. 68 percent of the project budget came from a bank construction loan. Another 18 percent stemmed from equity invested by the sponsor and larger investors, who were the first to invest and will be the last to receive payouts.

by an unconventional source: a directly crowdfunded offering of preferred equity to local investors, which covered 14 percent of the total project budget. 68 percent of the project budget came from a bank construction loan. Another 18 percent stemmed from equity invested by the sponsor and larger investors, who were the first to invest and will be the last to receive payouts.

Senior Lien: Locating the Lender and Underwriting

Guerrilla had purchased the land with its own equity, and decided to raise additional equity before pursuing a construction lender. “We had the value of the land at $500,000, and brought $600,000 in cash to them,” limiting the bank’s $1.5 million exposure to two-thirds of the total project cost. “We didn’t finalize anything [with the lender] until we had the cash in place, or a plan to get that cash,” continues Mackay.

The lender, a community bank based in another Oregon city, had made a permanent loan on a previous Guerrilla project. The bank “had seen enough of what we did and got us, on a level that’s kind of important . . . it’s always nice to feel understood by your lender,” says Mackay.

That understanding extended even to the very unusual concept at JFC. “They’d never seen anything like this, but didn’t freak out—or, if they did, they were able to mask it behind excitement,” continues Mackay.

Equity: Locating the Investors

While refining the idea, Guerrilla shopped the project to some long-term investors, “whom we call our ‘enlightened capital investors’—folks who’ve come on board for other deals,” particularly people who Cavenaugh and Mackay knew might accept lower upfront returns in exchange for a greater social impact. There was $300,000 that was raised from these investors, who hold 75 percent of the class A equity. Guerrilla’s $100,000 deferred developer fee also is invested as class A equity, which only receives distributions after preferred equity. (Equity of both classes will receive an equal share of any refinancing proceeds.)

Cavenaugh was an early champion of raising equity via crowdfunding, telling Locavesting that “we want everyday Portlanders to be able to invest in their neighborhood . . . it’s ethically important to cast a wider net to our investor pool,” given the country’s wealth inequality. The public disclosure required doesn’t trouble him, since Guerrilla has long offered a radical degree of transparency—including posting its projects’ plans and pro formas on its website.

Guerrilla had already built a sizable mailing list of potential crowdfunding investors via marketplaces and its own site. When it posted its first crowdfunding offering (and the first SEC Regulation A+ offering for a single-asset new construction real estate deal in the country), a $1.5 million stake in a colorful office building named the Fair-Haired Dumbbell, that list was “poised to jump right on it when the opportunity came along next,” says Mackay. Favorable press about the unusual project also helped; class B investor Ramsay Weit signed up after seeing a New York Times story. Although the FHD offering was open in several states, almost 90 percent of the 121 investors were from Portland.

When it came time to raise $300,000 in class B preferred equity for JFC, Guerrilla set up an in-state crowdfunding offering at a cost of about $49,000—mostly legal expenses, but also an online platform. The equity raise sold out in three days, with 43 investors (one-third of them unaccredited) contributing a minimum of $3,000 apiece for a 5 percent annual dividend and a share of appreciation after an eventual refinance. About half of JFC’s investors had also invested in FHD.

Equity: Underwriting

Weit, the class B investor, recalls that it wasn’t the rate of return that first caught his interest about FHD—just that “the return was beyond 5 percent.” (It was 8 percent.) Rather, FHD “was bold from a design perspective. It sounded like a very contemporary, provocative project.”

When Weit got an email from Guerrilla about Jolene, “I was on board—I wouldn’t say instantaneously, but quickly . . . I liked the mix of heart and mind, [combining] a fine return and a really ambitious social policy agenda,” he says, commending its “courage and inclusive thinking.”

As with FHD, consideration about the dividend “was momentary. It was a competitive rate” given the dollar amount. “When you look at the rates on bonds or other investments, 5 percent looks pretty good.” That it could have a social impact and would be invested locally were bigger considerations for Weit, who has dabbled in other impact investing.

Weit has a background in affordable housing finance, including 13 years running a local community development financial institution (CDFI). “I helped finance thousands of units with [nonprofit] CDCs, but to have a for-profit guy interested in doing SRO housing in a neighborhood setting” was unusual. The complicated legal structure of CDFIs requires large check amounts, and Weit sees JFC as a scalable “path for smaller-scale investments [that] don’t need to go through layers of legal.”

Public Financing

“We never took tax credits,” says Mackay, “but we were never too proud to ask for cost breaks” for the project. In particular, most of Portland’s steep impact fees were waived for the SRO in return for a 60-year affordability covenant on that unit.

Lessons Learned

Storytelling. Mackay was “struck with what wasn’t challenging” about JFC. “Funding projects never goes as fast as you think it will, except this one . . . [we’re] amazed at how hungry the public was” for an investment that combined a fair return with tangible, local social impact. She credits its success in lining up equity investors with both having an extensive contact list, as well as having a good story to tell—one that both fits with and completes its surroundings, while integrating a response to social needs.

“Invest local.” That appetite from limited-dividend equity investors has Guerrilla considering replicating the project (Jolene’s Second Cousin, and further iterations) entirely with equity funding, without any bank debt and its attendant fees and refinancing risk. Weit also sees broader interest among the investing public in “people trying to develop some pretty creative ways to finance the right stuff,” and broaden the investor pool. He points to a local CDC whose “community REIT” aims to address asset building among moderate-income residents.

Project Information

| Development timeline | Month/Year |

|---|---|

| Site purchased | June 2017 |

| Planning started | Summer 2017 |

| Equity raised | 2017 (Class A), 2018 (Class B) |

| Construction financing arranged | Spring 2018 |

| Construction started | Spring 2018 |

| Sales/leasing started | 2018 (retail) |

| Project opened | Summer 2019 |

| Development cost information | Amount in $ |

|---|---|

| Site acquisition & carrying cost | $522,927 |

| Hard costs | |

| Deconstruction (Owner-Provided) | $19,200 |

| Other Owner-Provided Hard Costs | $57,115.88 |

| Hard Cost Contract | $1,053,678 |

| Subtotal | $1,129,994 |

| Soft costs | |

| Pre-Dev Consultants | $22,619 |

| Construction Phase A&E | $25,000 |

| Development Fees | $177,000 |

| Crowdfunding Offering Expenses | $48,896 |

| Permit Fees | $92,794 |

| Construction Financing & Carrying | $123,949 |

| Other | $1,140 |

| Subtotal | $491,397.56 |

| Total development cost to date | $2,200,818 |

| Hard costs per sq ft | $171.21 |

| Total development costs per sq ft | $358.81 |

| Financing sources | Amount in $ | Terms (rate, length) |

|---|---|---|

| Debt capital sources | ||

| Bank loan | $1,500,000 | 5%, 24 months |

| Equity capital sources | ||

| Class B investors (crowdfunding, Preferred) | $300,000 | 5% annual dividend+ share of appreciation |

| Class A investors | $300,000 | Share of appreciation |

| Guerrilla Development | $100,000 | Share of appreciation |

| Total | $2,200,000 | |

Format

Deal Profiles

City

Portland

State/Province

OR

Country

USA

Metro Area

Portland

Project Type

Mixed Use

Location Type

Other Central City

Land Uses

Multifamily Rental Housing

Retail

Keywords

Affordable housing

Crowdfunding

Deal profiles

Dealprofiles

Housing for the homeless

Mixed-Income Development

Single-room-occupancy housing

Small-scale development

Site Size

0.11

acres

acres

hectares

Date Started

2017

Date Opened

2019

Website

http://guerrilladev.co/jolenes-first-cousin/

Video

https://vimeo.com/247367414

Address

2800 SE Gladstone Place

Portland Oregon 97202

Developer

Guerrilla Development Co.

Portland, Oregon

http://guerrilladev.co

Architect

Brett Schulz

Portland, Oregon

http://www.brettschulz.com/

Interviewees

Anna Mackay

Director of development, Guerrilla Development

Ramsay Weit

Retired; former executive director, Community Housing Fund