Format

Deal Profiles

City

Phoenix

State/Province

AZ

Country

USA

Metro Area

Phoenix

Project Type

Multifamily For-Sale

Location Type

Other Central City

Land Uses

Multifamily For-Sale Housing

Structured Parking

Keywords

Condominiums

Dealprofiles

Infill development

Rooftop solar panels

Single-family attached housing

Townhouses

Site Size

0.59

acres

acres

hectares

Date Started

2013

Date Opened

2016

A leftover infill site in central Phoenix is now home to 25 low-rise condominiums, with a modern design that maximizes the site and minimizes ongoing costs. artHAUS was an architect’s first foray into residential development; as he says, “the design part’s easy for me, but the financing part—that was a big-time learning curve” helped along by a ULI Arizona event.

Deal Profiles from the ULI Center for Capital Markets and Real Estate showcase how developers bring together financing for small but high-impact developments.

The Site and Neighborhood

Architect Jason Boyer had a lot on his mind in 2013. This particular 0.59-acre lot was less than a mile north of downtown Phoenix, and one block west of the new Central Avenue light rail line (see ULI Deal Profile: The Newton). The long-vacant lot had been used for construction staging when the city of Phoenix converted the circa-1956 Walsh Brothers Furniture showroom into a new home for the Arizona Opera.

The opera joined the nearby museums, libraries, theaters, and educational institutions within a newly established Central Arts District. West of the site is the Willo historic district, a rare oasis of 1920s bungalows amid Phoenix’s suburban expanse.

The Initial Idea

Boyer had decades of experience in commercial-scale architecture and some experience investing in residential real estate. He had yet to try his hand as a developer, but a downtown revitalization leader asked him to take a look at the site in 2013.

Boyer envisioned a small-scale community of 25 attainable for-sale houses, from 560-square-foot flats to 1803-square-foot, three-level townhouses. Taller units would line the street sides, with other units atop a single level of parking. It could forgo the costly frills found in larger complexes; instead of “no pool that no one swims in, no gym that no one works out in,” residents could claim discounts at local fitness studios. Instead of interior corridors with year-round air conditioning, exterior walkways would be shaded with solar panels — which could generate more than enough power to offset the HOA’s lighting bills.

The efficient, moderate-density layout split the scale difference between Willo’s bungalows and Central Avenue’s large institutions, and perfectly fit the new transit-oriented overlay zoning. The small, low-maintenance, energy-efficient condos would bring a complementary product to the established Willo neighborhood, with modern design appealing to urbane first-time homebuyers.

After some encouraging initial conversations outlining the scheme to neighbors and the city, the city put the land — then jointly owned by two different city departments — through a formal RFP process. Boyer handily won the RFP, and even better, negotiated to defer 85% of the $350,000 purchase price as subordinated debt.

The Idea Evolves

Fresh off securing control of the site, Boyer strode onto stage at a ULI Arizona Shark Tank event in November 2013. Craig Krumwiede, president and CEO of Harvard Investments, was one of the “sharks” on the stage, and recalls that Boyer “knew more about the architecture than I’ll ever know,” but “at that point in time, he didn’t know what he didn’t know about the whole capital side of the business. I think Shark Tank was an eye-opener for him, in that he didn’t really have an appreciation for how hard it is to raise capital.”

“The design part’s easy for me,” sighs Boyer, “but the financing part—that was a big-time learning curve” that just began then. “What really changed for me,” he continues, “was the ULI Shark Tank process. It was a game changer: all of a sudden, people were willing to pick up the phone… Even if they didn’t invest, they opened a lot of doors and provided great feedback.”

Besides his financing strategy, the sharks also questioned Boyer’s marketing strategy. Boyer, says Krumwiede, “had a very definite view about who his buyer was, and his product was keenly designed to that buyer.” Krumwiede suggested interiors that appealed to other market segments, particularly to move-down buyers. Boyer eventually learned the hard way that “who we thought the buyer profile would be is not what it was at all” in the end; instead, artHAUS residents include many late-career second-home buyers drawn to the design quality and downtown location. Krumwiede says, upon learning that, “ultimately, I’m sorry I was right.”

Boyer did hire a marketing consultant, who urged fewer but larger units. “In hindsight, absolutely that study was wrong,” he says; the smallest units, priced from $156,000, sold immediately while the larger townhouse units lingered on the market because “people don’t like stairs in Phoenix.”

Financial Overview

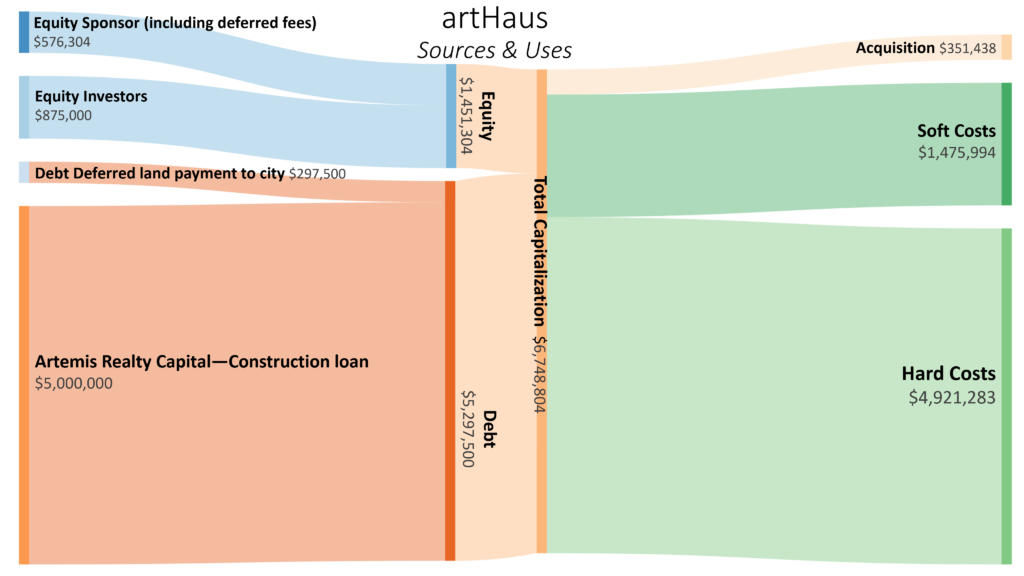

“It was a 75/25 capital stack,” says Boyer, with a $5 million construction loan from Artemis Realty Capital providing three-fourths of the financing and various equity sources accounting for one-fourth of the project cost. Much of the equity was cobbled together from unconventional sources, notably deferred professional services fees and a subordinated loan for land acquisition.

Senior Lien

Boyer spent a year chasing cold leads with banks: “Everybody was always ‘interested,’ but I had no clue that what they were saying was no, but politely… [then I] figured out that you have to talk to multiple people at one time.” Ultimately, he “talked to 12 banks before realizing traditional financing wasn’t going to work. I didn’t have a deep enough balance sheet personally, and I didn’t have a deep track record as a developer.”

A principal for private, asset-based lender Artemis Realty Capital lived nearby, and Boyer “had an ongoing conversation for a year” about the project’s progress. The principal, Boyer recalls, said “I showed some real tenacity in following through.”

Boyer says the price was “a little rich” compared to bank loans, “but appropriate given my level of experience. It didn’t feel very good at the time, but ultimately I had to believe in my ability to execute this project,” or else hand over control to someone else.

Artemis’ partners have development experience, and pride themselves on being responsive to developers’ needs with quick decisions and flexible underwriting criteria. The principal says of artHAUS, “we felt good about the market, the design, the cost and entry point, and the size of the development budget,” which matched its typical loan size of $3-8 million. Since “it’s always easy to get into a loan–you just write a check–but getting out is the hard part,” Artemis “underwrote it as a rental project… to under-market values.” Artemis did not require any presales, but did want 10 units under contract before agreeing to allow unit closings to begin paying down the loan. Eight were closed at the time, but Boyer was still cleared to close.

The Artemis principal says of Boyer, “it took a lot more effort on his part, and it was not the grand slam he thought it was going to be financially.” The loan’s 18-month term was extended by six months due to construction delays, and “I paid off their loan three days prior to the extension expiring.” The remaining unsold units would then payback investor equity, deferred fees due to the architect, preferred returns, and ultimately, profit distributions to the equity investors. (It would take almost two more years to sell out, but investors received more than the promised 19.35 percent internal rate of return.)

Equity

Raising equity proved just as daunting, though Boyer had a few cards up his sleeve. Boyer contributed “almost $210,000 of cash, plus $350,000 in deferred fees”–not just his architectural fees but also other consultants’, who got a 30% bonus if they deferred payment until all of the construction financing and deferred debt on the land was repaid..

Almost $1 million in cash came from the sponsor and four limited partners, who earned a 7% preferred return on investments ranging from $50,000 to $450,000. Most were family or friends; the value of those personal bonds became clear to Boyer when “we were set to close the construction loan. I sent [an investor who pledged $450,000] the wire instruction to send your money and then they go blank for six weeks… this was the person I knew the least, and they just got cold feet.” This had been the only investor Boyer hadn’t known previously, and the cash was eventually replaced with an investment from another investor/developer who’d been in a similar situation.

None of the “sharks” contributed equity, since their funds focused on other product types, but all of them subsequently met with Boyer to provide advice.

Public Financing

The 25% in equity also included $297,500 in subordinated debt to the city of Phoenix, which sold the land to Boyer. As long as Boyer could show progress, 85% of the purchase price could be paid with no interest after the construction loan was repaid. “The dirt deferral,” Boyer says, “was huge for me. At that time, $350,000 more felt like a massive hurdle.”

Lessons Learned

Prepare for no. Boyer found the construction financing process to be deeply humbling. “That’s the nature of development. A hurdle gets thrown up, you figure out how to get through, then five more pop up.” Krumwiede agrees that “there were a lot of disappointments along the way for him. Part of this business is being told no a lot… but it’s been a great experience for me to see him build a beautiful project in a great location.”

Know your market. Boyer, who is still a practicing architect, says “it won a few design awards, and that’s all great–but in the end, I would rather have sold it out quicker.” The “sharks” were correct about the buyer pool, and had Boyer known that, he says he would have planned better for dogs, storage, interior upgrades–and yes, “I would probably try to figure out a way to integrate a pool in the future.”

Project Information

| Project Timeline | |

|---|---|

| Planning began | April 2013 |

| City RFP open | Summer 2013 |

| Development Agreement reached with city | October 2013 |

| ULI Arizona Shark Tank | November 2013 |

| Equity raised | 2014 |

| Construction loan closed with Artemis Realty Capital | May 2015 |

| Site purchased | May 2015 |

| Groundbreaking | June 2015 |

| Project opens | August 2016 |

| Construction loan repaid | May 2017 |

| Last unit sold | February 2019 |

| Financing sources | Amount in $ | Terms |

|---|---|---|

| Debt capital sources | ||

| Artemis Realty Capital, construction loan | $5,000,000 | 24 months, ~9.75% interest |

| City of Phoenix, subordinated | $297,500 | Due after construction loan, no interest |

| Equity capital sources | ||

| Sponsor equity, including deferred fees | $576,304 | Share of appreciation |

| Limited partners | $875,000 | 7% preferred return + Share of appreciation |

| Total | $6,748,804 | |

| Development cost information | Amount in $ | Amount in $, per unit |

|---|---|---|

| Site acquisition | $351,438 | $14,058 |

| Hard costs | ||

| Construction cost | $4,686,936 | $187,477 |

| Contingency | $234,347 | $9,374 |

| Subtotal | $4,921,283 | $196,851 |

| Soft costs | ||

| Development expenses | $486,495 | $19,460 |

| Interest | $545,321 | $21,813 |

| Consultants | $368,921 | $14,757 |

| Permits and fees | $75,347 | $3,014 |

| Subtotal | $1,475,994 | $59,049 |

| Total development cost | $6,748,804 | $269,952 |

| Hard costs per sq ft | $148.49 | |

| Total development costs per sq ft | $203.63 | |

Format

Deal Profiles

City

Phoenix

State/Province

AZ

Country

USA

Metro Area

Phoenix

Project Type

Multifamily For-Sale

Location Type

Other Central City

Land Uses

Multifamily For-Sale Housing

Structured Parking

Keywords

Condominiums

Dealprofiles

Infill development

Rooftop solar panels

Single-family attached housing

Townhouses

Site Size

0.59

acres

acres

hectares

Date Started

2013

Date Opened

2016

Website

arthausphx.com

Address

1717 N. 1st Ave.

Phoenix, Arizona 85003

Developer and Architect

artHAUS Projects

Phoenix, Arizona

Interviewees

Jason Boyer

Principal, Studio Ma, Inc.

Craig Krumwiede

President and CEO, Harvard Investments

Principal Author

Payton Chung