Format

Deal Profiles

City

Van Wert

State/Province

OH

Country

USA

Metro Area

Columbus

Location Type

Small Town/Rural

Land Uses

Senior Housing

Keywords

Assisted living housing

Deal Profile

Deal profiles

Dealprofiles

Elderly/senior housing

Elderly/seniors’ housing

Senior housing

Site Size

6

acres

acres

hectares

Date Started

2019

Date Opened

2021

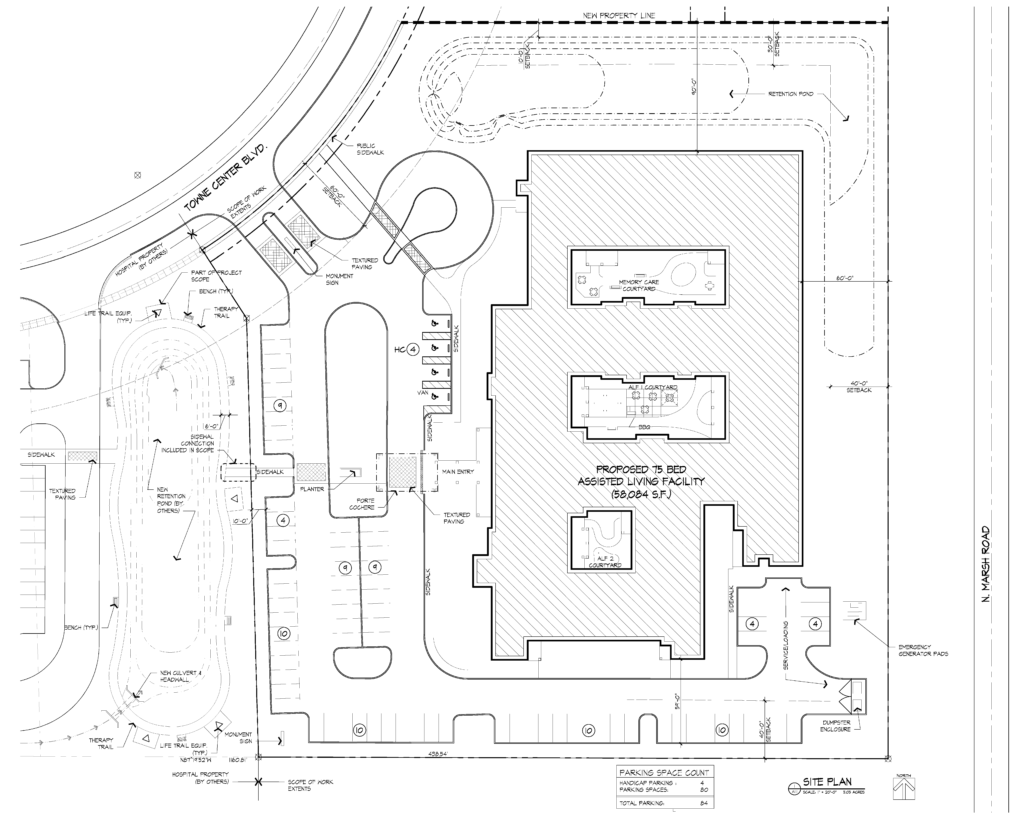

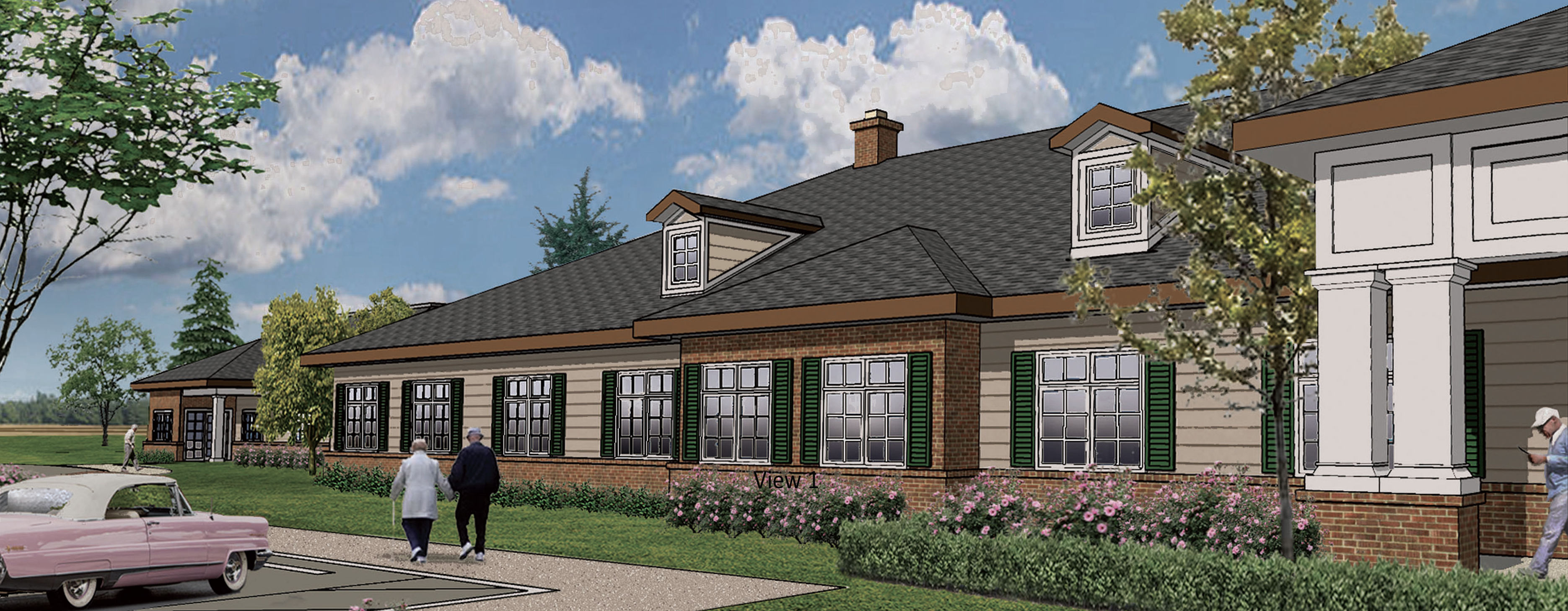

When complete, this ground up development in the City of Van Wert, OH, will have 56,000 square feet of space for 75 beds to serve senior citizens and memory care needs. The project was developed on an outparcel within an established retail center just off a highway interchange. This Deal Profile focuses on the process of placing and obtaining Property Assessed Clean Energy (PACE) financing as well as the intricate partnerships required.

The Site and Neighborhood

The Homestead at Towne Center is situated on the northern edge of the rural City of Van Wert, the county seat of Van Wert County in western Ohio, near the Indiana border. The once swamp-filled lands are now covered in over 390 square miles of farmland with some of the largest industries being manufacturing and healthcare. The median age in the county is 41 years, which is about 10% higher than the national average, and the population over 65 is about 20% higher than the national average.

With the project developer Equity having previous experience in the healthcare development sector as well as their preexisting ownership of the development site, an outparcel in the Van Wert Towne Center, the site selection of the of 5-acre outparcel for the 56,000 square foot, 75-bed assisted living and memory care center was an easy choice to make.

Sitting just off a highway interchange, the location offers easy access to and from other major cities in Ohio such as Toledo, and Dayton, as well as being just 45 minutes from Fort Wayne, Indiana. With Van Wert’s higher than average senior population, the developer as well as local officials thought that the location, operating structure, partnerships, and idea would be a great fit to take advantage of an empty outparcel in a thriving retail anchored center with an already established outpatient hospital clinic, all to serve the senior demographic needs.

The Initial Idea

While working on a separate assisted living facility in Florida, Equity partnered with Health Care Managers, Inc., a Florida-based owner/operator of several assisted living facilities. Health Care Managers, Inc. was founded by Steven Sell, whose ancestors immigrated to the Van Wert area in the late 19th century, where he still has family living today. In casual conversation with Sell, the City of Van Wert came up, and “the stars aligned” according to Anthony Zerrer, a development associate at Equity. Equity still

possessed the undeveloped site in Van Wert, adjacent to a prior project. The idea materialized from that conversation to use the empty outparcel for an assisted living facility, once again in partnership with Steven Sell and Health Care Managers, Inc. Though there were already some senior living facilities in the area, Van Wert County’s higher percentage of over-65 individuals and need of newer assisted living inventory ensured the project was viable.

The Evolution of the Idea

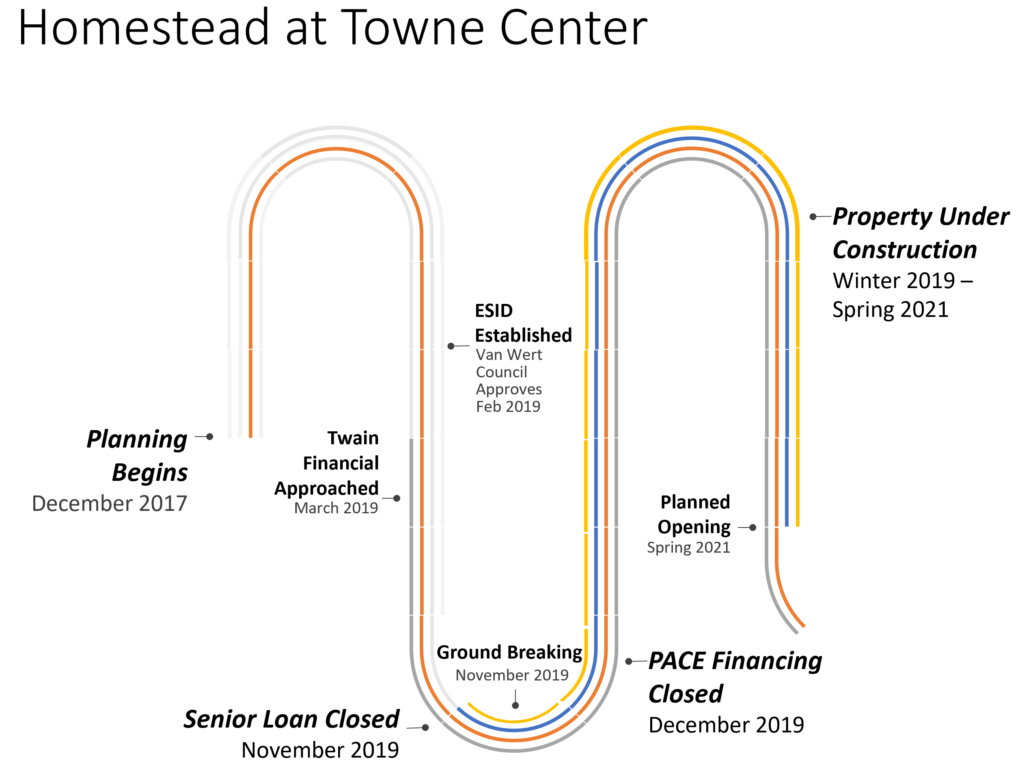

Despite having a site and a plan, Equity’s strategy involved obtaining PACE financing to fully capitalize the deal. PACE stands for Property Assessed Clean Energy—it is a state-based financing program that offers upfront funding for energy efficiency, renewable energy and water conservation components of real estate development projects. Equity had used PACE funding on previous projects, and though PACE financing is typically associated with hospitality and multifamily developments, in the words of Zerrer “Senior living is the next closest property type to multifamily.” Equity reasoned that there was no reason why they could not apply PACE to both improve the energy efficiency of the building and as a substitute for mezzanine debt to help bridge the financing gap, as long as they could find support from the municipality to create the necessary PACE frameworks.

Financial Overview

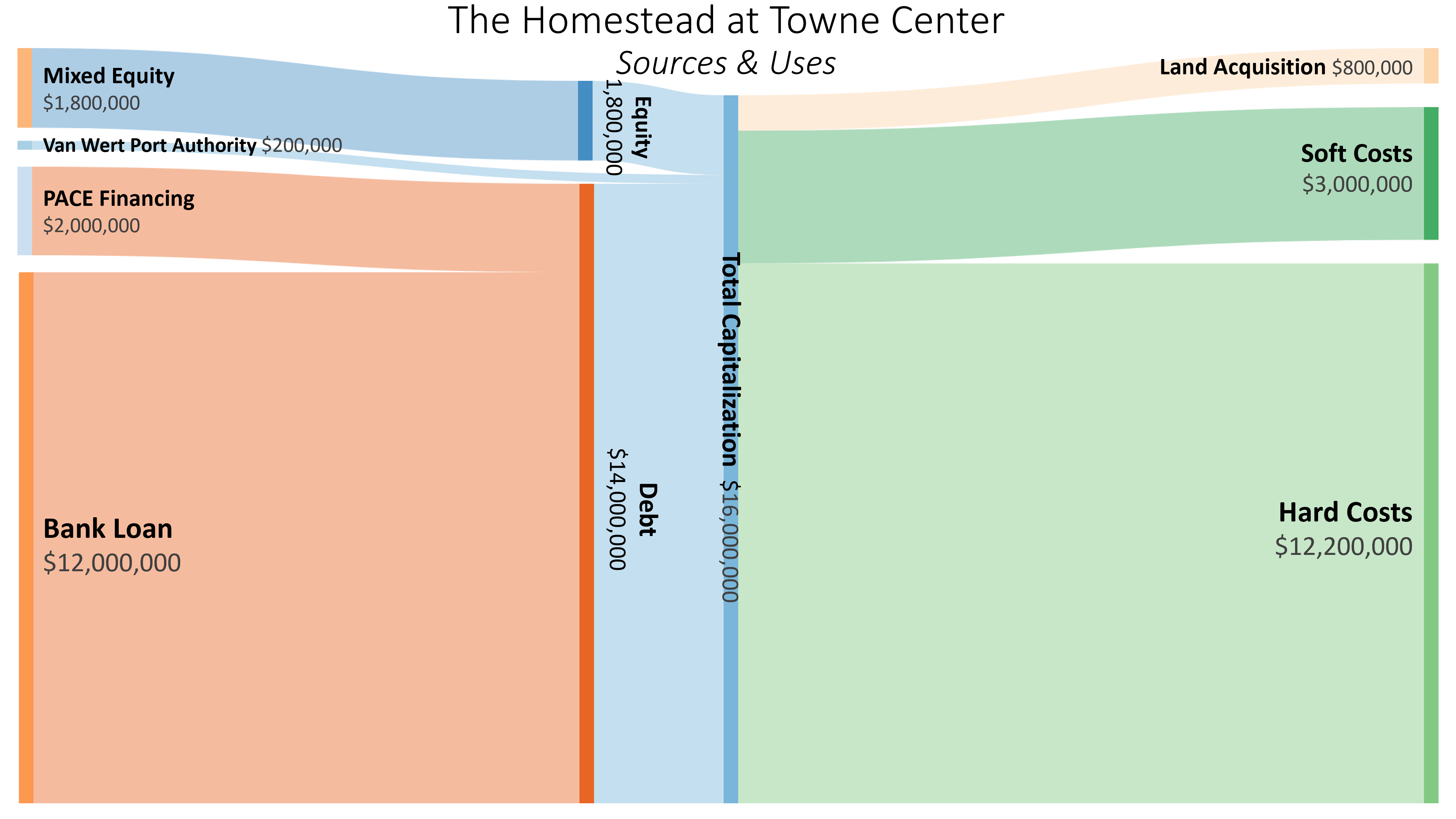

Finding the right balance of debt and equity is an equilibrium that is required to be found for any real estate project, and The Homestead at Towne Center was no different, taking Equity 1.5 years to assemble the funding. With only 11% of the total capitalization being in the form of equity, the developer had to turn to other sources to fully capitalize the $16 million senior living center development. After the $12 million senior note was secured from a local credit union, sources to fill the $4 million gap included $2 million of PACE financing, $200,000 from the Van Wert Port Authority, and $1,800,000 of creatively sourced equity.

Senior Debt

Serving as the base of the capital stack was a $12 million loan from Kemba Credit Union. Finding the right lender was important for Equity, and by utilizing their in-house mortgage broker, Leverage Capital, they were ultimately able to identify West Chester, OH-based Kemba Credit Union. While Equity was identifying prospective senior lenders, Kemba was looking to make a push into the Columbus commercial real estate debt space. Kemba was supportive throughout the entire financing process, especially when the reciprocal relationship between Kemba and the PACE financier was critical.

One of the key sticking points of the PACE financing is that the lien sits higher than the senior debt, at the same level as a lien from property taxes would. Many lenders are not comfortable with this level of exposure to not being made whole in the event of a default. However, some lenders find comfort in the fact that PACE is non-accelerable debt and can be escrowed similar to real estate taxes. Not only was Kemba onboard with the terms of the PACE financing, but they considered the PACE proceeds as equity when looking at its placement in the capital stack, allowing the project to receive higher leverage.

As Zererr describes The Homestead at Towne Center’s funding, he says that, “at first glance it doesn’t look too crazy, but once you get into it it’s a lot more detailed than it looks, once we found the right lender it really was pretty simple.” This serves to underscore the importance of the role that the senior lender, Kemba Credit Union played.

PACE Financing

The first step before applying for PACE Financing was engaging the Van Wert City Council to establish an Energy Special Improvement District (ESID), a necessary hurdle to establish PACE financing. The specifics vary by jurisdiction, but in general, PACE financing provides up-front funds for energy improvements which are greater than what is required by efficiency codes; this loan is paid back through special tax assessments. The lien is at the same level as unpaid property taxes, and specific to Ohio, the county collects the assessment and remits it to the city, which then in turn remits the funds to the PACE financier. In the words of Vanessa Asaro of Twain Financial, the project’s PACE lender, “It sounds pretty simple but there’s definitely a lot that goes into each loan.” In setting up the ESID, Anthony Zerrer says the assistance of Stacey Adam, Executive Director of the Van Wert Area Economic Development Corporation, was pivotal, entailing over a year and a half of orchestration regarding the zoning process, governing approvals, and garnering community support for the project.

With Homestead at Towne Center being the sponsor project of the new Energy Special Improvement District, the process was much longer than it will likely be for future projects within the district, however in the end, the work put in by both Equity and local stakeholders will likely pay dividends in the future; “For small local municipalities, this is definitely a marketing tool,” said Zerrer. If other developers would like to take advantage of PACE financing in the area, the upfront work has been done by both Equity and the municipality.

Though receiving enough votes from the city council to establish the ESID was an important and necessary step in the PACE financing process, there was more needed to secure the financing. Overall, the project totaled $16M, but after their land contribution, Equity had limited additional resources to invest. This made it difficult to find a suitable partner for the PACE funding, as it “stretched the requirements of most lenders,” Zerrer said; this is in addition to ensuring the PACE financier and other lenders are committed to working in cooperation on the project. Due to the high lien position of PACE funding, which the primary lender must consent to, the relationship between the senior debt holder and the PACE financier is crucial. Vanessa Asaro said that Equity was able to get ahead of these intricacies by assembling due diligence documents in advance, coordinating between Twain and Kemba Credit Union, and working hard to assemble a diverse capital stack, of which Twain’s $2,000,000 PACE financing was 12.5%. “From our perspective, that was great” said Vanessa, “we look for a maximum of 25% loan-to-value ratio.”

The interest rate for PACE financing generally follows the 20-25 US Treasury rate, and holds a 20-25 year term based on the useful life of the energy improvements, which in this case were top-to-bottom, from the roof and walls to the doors and washing machines. An independent, third-party energy analysis and audit is also necessary to ensure the amount and term of the loan is not beyond the value and useful life of any improvements. Vanessa added that there is room for PACE funding to expand “especially in the current environment, where projects may not be getting as much financing from banks. PACE is a good option, though people may not be as aware of it.” Additionally, PACE products such as those that Twain offers can be used to recapitalize projects currently under construction or recently completed. This can allow for property owners and developers to reduce more expensive debt service and/or bring in additional capital.

Equity

As is in many cases with real estate development projects, the equity placed into a capital stack does not come from just one source, but is made up of various parties who believe in not only the financial feasibility, but also the positive impact that the project will create for the community that it serves; the equity that was invested into this project was a testament to just that. The $1,800,000 total equity contribution encompassed the developers land, an architect fee deferral, and investment from the operator of the center.

Equity has owned the development site for 15 years. Over the course of this time, they have turned it into a thriving shopping center catering to the community’s needs by offering restaurants, auto, shopping, grocery, and health and wellness services. On the south-east corner of the site lays the outparcel where The Homestead at Towne Center will sit. Instead of directly selling the land to the development entity, Equity decided to contribute the land and in return, take an $800,000 equity stake in project.

The operator of the senior living center, Health Care Managers, Inc. decided not only to manage operations, but become financially involved by taking a position in the project as well, along with the architect who deferred part of their fee as an equity contribution. These commitments from the individuals directly involved in the project showcase how much they believe in the work that they are doing.

Public Financing

Another source of the deal’s financing was involvement from the Port Authority, surprising to hear for an inland area such as Van Wert, Ohio. This is a financing mechanism particular to Ohio, where counties use the Port Authority as an Economic Development platform to encourage development. In the case of The Homestead at Towne Center, a partnership was formed where the Port Authority owns the rights to the land, and after a set period of time, for this deal two years, transfers the land back to the original owner for a nominal fee. The Port Authority benefits by charging fees to the developer, around $50,000 in the case of the Homestead at Towne Center deal. The developer benefits by getting tax exemptions when acquiring their construction materials, which in Ohio are normally subject to a 7.5% tax. The exemption ultimately netted Equity around $200,000 in benefits which went into the deal like equity.

Lessons Learned

Right Capital Stack in The Right Location – To call the circumstances which lead to the partnership between Health Care Managers and Equity fortuitous would be an understatement, but ultimately the deal was fundamentally sound because of the most basic of real estate doctrines, location, location, location. Van Wert’s higher than average senior population and need for more modern senior living facilities were the foundation of the deal. But assembling the capital stack was another matter altogether. It took 1.5 years for Equity to find the right partners and right composition of capital to make the deal work.

Dialing in The Right Amount of PACE – Fine-tuning the PACE financing was one of the most difficult parts of the deal. Equity approached at least a half-dozen PACE lenders before solidifying financing with Twain Financial. Various aspects of the deal proved to be obstacles, including the loan-to-value ratio, the property type, and potential conflicts with the senior lender due to the PACE funding’s lien position. Coordinating between the senior lender and the PACE financier was pivotal to successfully navigating the deal and assembling the capital stack.

Makes Doing the Right Thing Easier to Do – PACE Financing, though typically associated with hotel and multifamily projects, can be applied to many asset classes. As both Vanessa Asaro and Anthony Zerrer emphasized, once the hard work of establishing an Energy Special Improvement District is completed, PACE financing can be a useful mezzanine debt option, as well as enable developers to embrace long-term energy efficiency investments in situations where the up-front costs would normally be prohibitively out of reach.

Format

Deal Profiles

City

Van Wert

State/Province

OH

Country

USA

Metro Area

Columbus

Location Type

Small Town/Rural

Land Uses

Senior Housing

Keywords

Assisted living housing

Deal Profile

Deal profiles

Dealprofiles

Elderly/senior housing

Elderly/seniors’ housing

Senior housing

Site Size

6

acres

acres

hectares

Date Started

2019

Date Opened

2021

Project Information

Address

4313 SE Town Center Blvd

Van Wert, OH 45891

Developer

Equity, LLC

Architect

Architectural Concepts Inc

General Contractor

Equity Construction Solutions

Interviewees

Anthony Zerrer

Development Associate

Equity, LLC

Vanessa Asaro

Investment Associate

Twain Financial Partners

Principal Authors

Jacob Behrmann

Clayton Daneker