Format

Deal Profiles

City

Capitol Heights

State/Province

MD

Country

USA

Metro Area

Washington

Project Type

Multifamily Rental

Location Type

Inner Suburban

Land Uses

Multifamily Rental Housing

Keywords

Affordable housing

Affordable housing preservation

Deal profiles

Dealprofiles

Energy-efficient

Neighborhood revitalization

Renewable energy

Rooftop solar panels

Solar Panels

Site Size

2.04

acres

acres

hectares

Date Started

2016

Date Opened

2018

This 44-unit rehab, financed by three mission-driven lenders, preserved workforce-affordable homes, reduced crime in the neighborhood—and meets nearly all of its annual electric demand via on-site solar.

Deal Profiles from the ULI Center for Capital Markets and Real Estate showcase how developers bring together financing for small but high-impact developments.

View a webinar of a June 2019 webinar for ULI members, featuring a presentation by Chris VanArsdale of VNV Development and a discussion with Monica Warren-Jones of Enterprise Community Partners, moderated by Philip Payne of Ginkgo Residential.

Read an abridged version of this Deal Profile, as published in Urban Land magazine.

The Site and Neighborhood

Sun Crest Heights was built in 1972 as Crest Apartments, a 44-unit complex of two three-story structures in Coral Hills, Maryland, less than one mile east of the District of Columbia. It sits along Marlboro Pike, a winding arterial that was once the primary route linking Washington, D.C., to Upper Marlboro, the seat of Prince George’s County and a former tobacco port. Marlboro Pike was a primary route for postwar suburbanization, but its business prospects dimmed during the 1960s when it was bypassed by a higher-speed extension of Pennsylvania Avenue. The area saw substantial disinvestment and blight starting in the 1980s.

Efforts to revitalize the area have included redevelopment of public housing complexes in both Maryland and the District. The county’s redevelopment authority has broken ground on a mixed-use town center abutting a Metro station and a federal office complex one mile to the south, and new senior housing has been completed two blocks away.

The Initial Idea

Developer Chris VanArsdale, who had experience with clean-energy projects inside the District, had heard about a local nonprofit organization’s loan fund aimed at stabilizing class B apartments in suburban Maryland. He hoped to find a property that “would be ordinary, do a few apartment turns and stabilize, then a long-term hold,” with some energy upgrades (solar panels, insulation, lighting, appliances) to reduce operating costs. A broker brought Crest Apartments (its name then) to his attention, pointing out its high occupancy rate and close-in location.

The Idea Evolves

Crest Apartments turned out to have a lot hidden under the hood. “If we had known the problems, we would have run away,” says VanArsdale. “Probably half the leases were fraudulent, or had people living there who were not on the leases. There was a drug and gun operation being run out of the building that was concealed from us during due diligence,” he says. (At the time, the property manager said that some rent checks were missing because they were paid to the owner.) Several months of 24/7 police work resulted in numerous arrests and “cars impounded, with trunks filled with guns.” VanArsdale gives kudos to the Prince George’s Police Department as well as a “heroic” property manager, “given the physical safety concerns.”

Almost a year later, the property was finally quiet at night, but the owners now had dozens of empty units, mounting vacancy losses, and unforeseen repair bills. The developer had to make lemonade from these lemons. “We realized that with all these units vacating, even just turning the units was going to be expensive. We needed a value-add strategy to improve its long-term position,” says VanArsdale.

“It was clear that the interior configuration was not very efficient, with significant wasted space,” he continues, “and by just shifting interior walls, we could increase the number of bedrooms per unit and create a more open plan.” Adding bedrooms increased the gross rent potential, especially given a tight market for family-sized rentals. However, extensive in-unit renovations were beyond the initial project scope, which required going out for a second round of funding.

Financial Overview

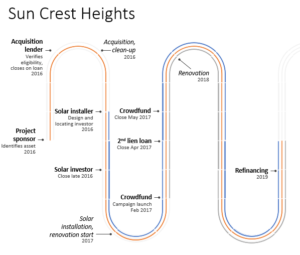

Sun Crest Heights’ repositioning was conceived around a particular acquisition loan product that offered an advantageous interest rate. That loan fund contributed almost three-fourths of the total project cost. A solar investor fully financed the cost of solar panels. Sponsor equity and two junior liens (from another nonprofit lender and a crowdfunding platform) rounded out the capital stack.

Senior Debt (Acquisition): Enterprise Community Loan Fund

The initial acquisition was financed by Enterprise Community Loan Fund, a community development finance institution (CDFI) affiliate of Enterprise Community Partners. Enterprise Community Partners is a national nonprofit organization focused on making well-designed homes affordable. Launched by developer and longtime ULI supporter Jim Rouse, the organization has invested in over half a million affordable homes across the United States.

Enterprise had recently launched a new loan product in 2015, capitalized by the state of Maryland with funds from a national settlement with a lender over subprime mortgage fraud. Some of that settlement money was dedicated to preserving existing affordable rental housing in low-income census tracts. Enterprise could use its existing underwriting platform to aggregate the state funds with its existing lending products, furthering its impact. The plan was to offer 0 percent interest acquisition loans as a way to put workforce-affordability covenants on properties, ensuring that rents would be affordable to residents earning below 120 percent of area median income. Enterprise lent $2.546 million from the Maryland fund to Sun Crest Heights, matching those funds with $1.396 million lent at a market interest rate.

“This was our first deal with the state settlement funds, and it was pretty challenging to try and find the right partner and project that aligned with the state’s requirements,” says Monica Warren-Jones, director of capital solutions, Mid-Atlantic, at Enterprise. “We have a fiduciary interest with public funds, so we want to make sure we make the right match so that funds are repaid and recycled for other transactions.”

Outreach to county housing departments and to industry groups including ULI garnered some leads. Sun Crest was the first deal completed using this fund; besides meeting the loan fund’s location criteria, the sponsor understood many of Enterprise’s other strategies, such as using energy improvements to reduce operating costs.

What Warren-Jones found promising about the deal was that “we had a partner who was vested in the deal itself and was committed to giving residents better living circumstances while improving the quality of the asset.” The first step, she continues, was “to find good property management willing to do a lot of cleanup”a task that is “not for the faint of heart.”

Appraisals proved to be a challenge during the underwriting process. Since the area had not seen much recent investment, “there weren’t a lot of comps—but we had to get comfortable with that,” says Warren-Jones, noting that Enterprise staff did their own valuation scenarios. Sponsorship also was critical at this stage, with the sponsors executing guarantees.

When stabilizing the complex took considerably longer than expected, VanArsdale took advantage of a six-month extension in the initial acquisition loan term. Warren-Jones says that a CDFI understands the flexibility often needed in underwriting properties with multiple challenges: “One thing we anticipate when we underwrite is . . . creating a term that takes into account the hiccups that might happen. It’s not in our interest to go into default, but rather to ensure the loan remains in good standing while our borrower focuses on the best development strategy.”

She credits VanArsdale with keeping Enterprise involved throughout the process: “If there are problems, we prefer to get on top of that before maturity. . . . We had really excellent communication with the borrower, who was very forthright about the tenancy issues.”

Equity (Solar Installation and Investment): GRID Alternatives

The $800,000 photovoltaic (PV) solar array was installed by GRID Alternatives Mid-Atlantic, a local nonprofit entity that seeks to make PV technology accessible to underserved communities, both through workforce training programs and as a solar engineering, procurement, and construction (EPC) contractor. GRID Mid-Atlantic serves low- to moderate-income communities in Maryland, Virginia, Delaware, and the District of Columbia.

“As a nonprofit, we pride ourselves in taking some risks a lot of for-profit companies wouldn’t necessarily be interested in,” says Nicole Steele, executive director of GRID Alternatives Mid-Atlantic. “Because we’re a nonprofit, we don’t have a tax [credit] appetite, so we have to partner with financing agencies to bring tax equity to the table.”

In Sun Crest’s case, GRID partnered with a solar financier, who owns the solar system and holds a power purchase agreement (PPA)—a long-term contract to sell the resulting electricity back to the apartment complex at a prenegotiated rate below what the utility charges. As the EPC on the project, GRID has a fixed-price contract with the financier to install the system. In addition to selling the power, the solar financier received a federal solar investment tax credit, as well as solar renewable energy certificates (SRECs)—credits that can be sold to a utility as proof that renewable energy went into its electric grid. SRECs are more valuable in states that require a high proportion of renewables.

Steele says that GRID had to “be diligent about figuring out what we would need to do to make this project attractive” to the right investor. Simply covering two rooftops with photovoltaic panels would have resulted in about 170 kW of capacity. Investors “balked at the smaller size,” says Steele, so GRID and VanArsdale agreed to add capacity by building a steel-and-concrete solar-roofed carport over part of the parking lot. Even the resulting 260-kW system left investors wary of the deal’s profitability, given the low SREC prices in Maryland.

Just a few blocks away, though, was the District of Columbia. Its lofty environmental aspirations had created “the most valuable SREC market in the country,” says Steele, and “this project was financially possible because it’s on a D.C. feeder line.” It took numerous inquiries to the District’s government and utility to finally get a determination that the parcel’s electric generation does feed into the District, and could therefore participate in its more lucrative SREC market. This uncertainty “carried some significant risks to the financier,” adds Steele.

The PPA arrangement minimizes upfront costs, and is particularly advantageous for GRID’s customers; few of them have substantial tax liabilities, and therefore cannot benefit from the tax credit. However, it does create a long-term liability for property owners, who are tied to the contract for a minimum of five years—the original owner’s depreciation period for the solar investment.

Delays and cost overruns affected all three parties to the transaction. “It’s been a fun adventure,” says Steele. Months after filing its plans, the electric utility told GRID that that volume of energy would require a $50,000 transformer upgrade—a cost that would balloon due to various other expenses, ranging from labor to the need to bring in generators to keep the lights on during the work. In addition, extensive rewiring was needed across the entire property. The developer paid for the rewiring, the financier paid for the transformer, and GRID absorbed additional installation costs.

On the upside, “solar really transformed the look and feel of the property,” says VanArsdale, adding a futuristic sheen to what were tired buildings, and making its transformation readily visible to passersby.

Junior Debt (Renovation): City First Enterprises

When the project turned out to be substantially more complicated than expected, VanArsdale initially considered funding the renovations with additional equity, but instead turned to two mission-driven lenders. Besides recouping vacancy losses, he says that “with the renovations and value-add reconfiguration, the numbers easily supported additional financing.”

City First Enterprises is a nonprofit bank holding company and CDFI based in Washington, D.C. Its commercial bank subsidiary, City First Bank, lends at least 85 percent of its capital to community causes such as affordable housing, charter schools, and arts facilities. Unusual among banks, even the for-profit City First Bank is incorporated as a benefit corporation, or “B Corp,” placing economic, social, and environmental justice on par with fiscal obligations. VanArsdale had a preexisting relationship with City First and secured a $442,000 term loan from City First Enterprises, its nonprofit CDFI arm, at an 8 percent interest rate.

Junior Debt (Renovation): Small Change

For the most junior mortgage ($200,000 at a 10 percent interest rate), VanArsdale compared a few crowdfunding platforms and decided to work with Small Change, an impact-investing startup based in Pittsburgh. Small Change differentiates itself from other real estate crowdfunding platforms by appealing to social impact investors; its due diligence evaluates not just finances, but also a “Small Change Index” that takes into account the project’s impact on mobility, the surrounding community, and economic vitality, through measures like a site’s Walk Score and transit access, proximity to services, and capacity to create jobs or homes for underserved communities.

So far, Small Change has closed equity and debt investments in 11 projects, ranging from construction of a single tiny house to office building renovations. In addition to the social screening, Small Change applies more conventional underwriting criteria to ensure that the project sponsors have the capacity to complete their projects; “No more than one in 10 projects make it all the way through the end,” says Eve Picker, Small Change’s founder and CEO.

Small Change has a platform business model, presenting potential investors with a marketplace of projects that they can choose from—“an exchange where we provide tools for the issuer to do marketing on behalf of their project,” says Ben Schulman, communications director for Small Change. Marketing on the platform has proved to be as much a tool for funding as for marketing and outreach; developers can point to their participation as proof (perhaps to skeptical neighbors or lenders) that their project has literal buy-in from a community.

VanArsdale notes that the platform approach comes with a fair amount of watching and waiting: “The challenge is that it’s not a guaranteed raise, so it’s months of not knowing whether you’re going to get investors,” especially given that the startup currently has a limited investor pool.

Drumming up interest among the investor base took a bit of coaxing, says Schulman: “Initially, there was a disconnect: this wasn’t urban, but it fills a need.” Many of the platform’s investors might prefer something with more charming architecture and in a more recognizable location, but ultimately understood that “the aesthetics are immaterial if stewardship and management are in place to improve comfort and maintain affordability.” Picker adds that Sun Crest drew attention on the platform because it is “in an appreciating market, while allowing people of modest means to take advantage of solid, updated housing.”

Schulman says that the solar installation definitely drew attention and improved its curb appeal on the platform. The solar further boosted its impact-investing credentials by creating tangible evidence of its sustainability and GRID’s workforce training opportunities.

Sun Crest’s loan was open only to accredited investors (e.g.,high-net-worth individuals), but Small Change sees wide potential in “regulation CF” investments that can be marketed to small-dollar investors. These deals are limited by the Securities and Exchange Commission to $1 million apiece, but Schulman points out that for “creative, incremental deals that create catalytic conditions for neighborhoods . . . $1 million can give you a lot of leverage” when applied as equity or to predevelopment expenses.

In cases where additional capital is needed, newer offerings are done “side-by-side” so that accredited investors can place larger sums alongside crowdfunding investors.

Permanent Debt

VanArsdale hopes to close on permanent financing for the property in early 2019. Initially, he expected that mortgage brokers would offer loans backed by the mortgage finance agencies’ programs for both green buildings and affordable housing.

Initial conversations with lenders have not found any significantly favorable pricing for these programs at the individual loan level, though, especially given the already competitive pricing for multifamily mortgage–backed securities.

Lessons Learned

Unexpected rewards. “The best outcome was its transformative impact on the community,” says VanArsdale, a reward that required considerably more time and capital than initially expected, as well as significantly expanding the project’s scope. Secondarily, he is proud that Sun Crest “gets to near net zero [energy use] on a multifamily building. Some is efficiency, but primarily it was the scale of the renewables.”

Look beyond boundaries. For solar installers like GRID, Sun Crest opens up two new approaches to the D.C. market—first, the ability to maximize on-site generation beyond rooftops, and second, to sell that electricity across borders. Other projects that would have been considered too small—especially given institutional investors’ demand for portfolio-scale projects—might become feasible given the right strategy.

Honesty. Thoughtful lenders like Enterprise want to work with project sponsors on their Plan B strategies, provided that sponsors clearly communicate what is going on and how they intend to address the situation.

A complete incentive toolbox. Debt was a useful strategy for getting affordability covenants onto the property, but affordable properties have limited debt-service capacity. Instead, Warren-Jones notes that more patient “equity-style capital would allow us to have some involvement and stay in the project.” For instance, Enterprise has been very active in outreach around Opportunity Zones, for which Maryland has announced additional incentives and technical assistance. She also thinks that future deals like Sun Crest would benefit from a more holistic approach from local and state governments—a strategy that the county has taken by designating the area for its Transforming Neighborhoods Initiative. Loan funds, she says, could be “complemented with state infrastructure resources . . . absent those amenities, these projects end up isolated” and neglected.

Project Information

Format

Deal Profiles

City

Capitol Heights

State/Province

MD

Country

USA

Metro Area

Washington

Project Type

Multifamily Rental

Location Type

Inner Suburban

Land Uses

Multifamily Rental Housing

Keywords

Affordable housing

Affordable housing preservation

Deal profiles

Dealprofiles

Energy-efficient

Neighborhood revitalization

Renewable energy

Rooftop solar panels

Solar Panels

Site Size

2.04

acres

acres

hectares

Date Started

2016

Date Opened

2018

Address

5225 Marlboro Pike

Capitol Heights MD 20743

Developer

VNV Development

Washington, DC

Property management

Innovations Group, LLC

Interviewees

Chris VanArsdale

Principal, VNV Development

Monica Warren-Jones

Director of Capital Solutions, Mid-Atlantic, Enterprise Community Partners

Ben Schulman

Communications Director, Small Change

Nicole Steele

Executive Director, GRID Alternatives Mid-Atlantic

Principal Author

Payton Chung